US dollar, Straits Times Index, Copper

[ad_1] Market Recap Major US indices ended the day slightly underwater (DJIA -0.19%; S&P 500 -0.25%; Nasdaq -0.10%), as the US 10-year Treasury yields continue to head to its highest level in almost nine months, following through with the recent announcement that the US Treasury would boost its issuance of long-term debt this quarter. Recommended

[ad_1]

Market Recap

Major US indices ended the day slightly underwater (DJIA -0.19%; S&P 500 -0.25%; Nasdaq -0.10%), as the US 10-year Treasury yields continue to head to its highest level in almost nine months, following through with the recent announcement that the US Treasury would boost its issuance of long-term debt this quarter.

Recommended by Jun Rong Yeap

How to Trade FX with Your Stock Trading Strategy

The release of the US ISM services purchasing managers index (PMI) (52.7 versus 53 forecast) has been mixed as well, particularly with the renewed pull-ahead in services’ prices (56.8 vs 52.1 forecast) which suggests that inflation progress could potentially be harder to come by ahead. Overall, that has kept the lid on the recent equities’ rally, which are already seeing some near-term signs of exhaustion, before attention was shifted to Apple and Amazon’s earnings release.

Better-than-expected growth in Apple’s services division (8% growth YoY vs previous 5.5% in previous quarter) and resilient iPhone sales in China have been the bright spot in Apple’s latest results, but market participants found some discomfort with the continued weakness in its hardware products, which was guided to last into the current quarter. Its share price is lower by 2% after-market.

The positive surprise came from Amazon, with its previous cost-cutting measures translating to an almost two-fold beat in earnings per share. Revenue growth has also returned to the double-digit territory as well (11% year-on-year), with management’s guidance for the strength to continue. The outperformance on all fronts (including Amazon Web Services and advertising) suggests that market expectations have previously underestimated Amazon’s resilience, which prompts a 9% jump in its share price after-market.

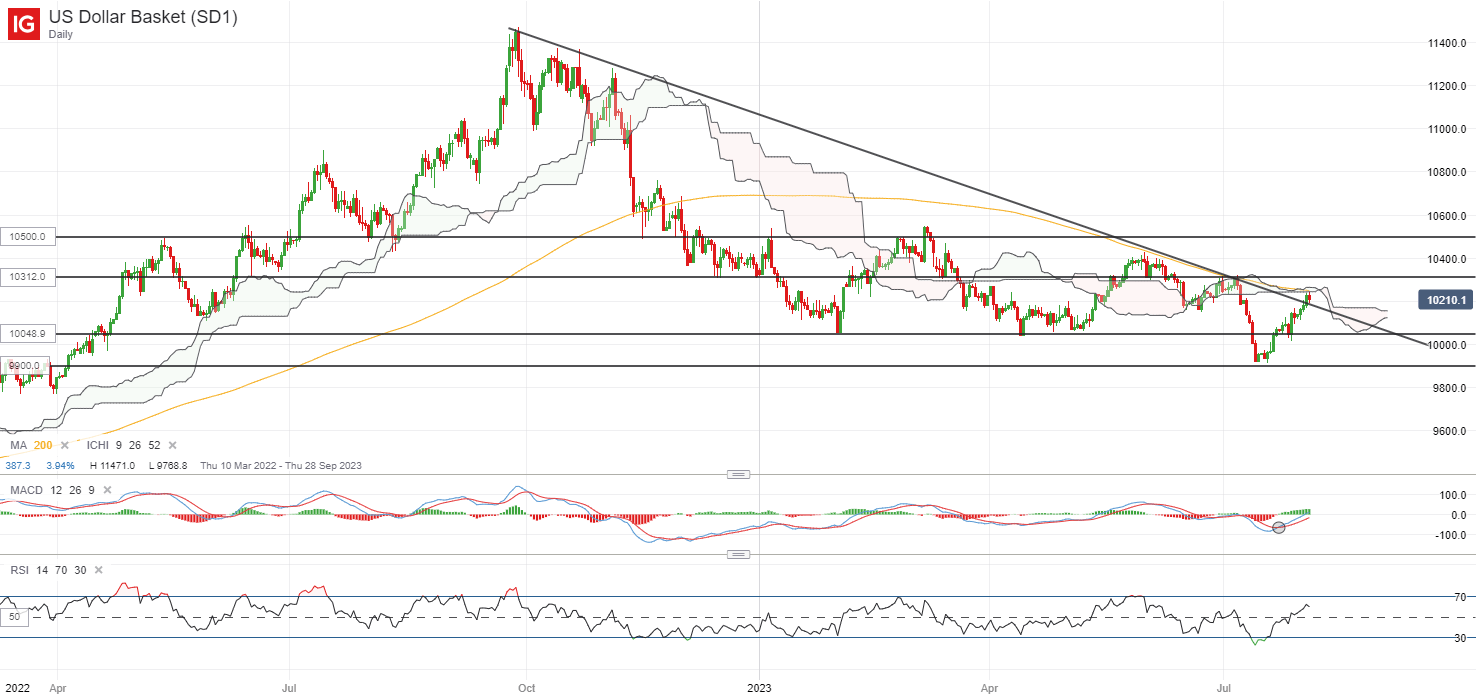

Ahead, the US non-farm payroll data will be the key focus, where a more lukewarm figure may likely make the case for the Fed to transit into a prolonged rate pause while supporting soft landing hopes. Current expectations are for 184,000 job additions in July, compared to the previous month’s 209,000. Unemployment rate is expected to be held steady at 3.6%. The US dollar will be in focus, seemingly attempting for a break above a key downward trendline resistance, but given the lower highs and lower lows formation still in place, much still awaits. The 103.12 level will be a key resistance to overcome ahead, which marked its previous post-Fed sell-off. On the downside, the 100.50 level will stand as immediate support to watch.

Source: IG charts

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Asia Open

Asian stocks look set for a subdued open, with Nikkei +0.29%, ASX -0.01% and KOSPI -0.16% at the time of writing. Pockets of resilience were found in US-listed Chinese equities overnight, with the Nasdaq Golden Dragon China Index up 3.5%.

Following DBS earnings release yesterday, OCBC’s results today will mark the last of local banks’ earnings. The bank posted a 34% rise in 2Q net profit which slightly missed estimates, while economic headwinds into 2024 has been guided, which puts a less optimistic growth outlook in place compared to the other two banks. Dividends were raised to S$0.40 per share, up 43% from a year ago but given that share price has reacted with a strong rally to UOB’s results, much may have been priced.

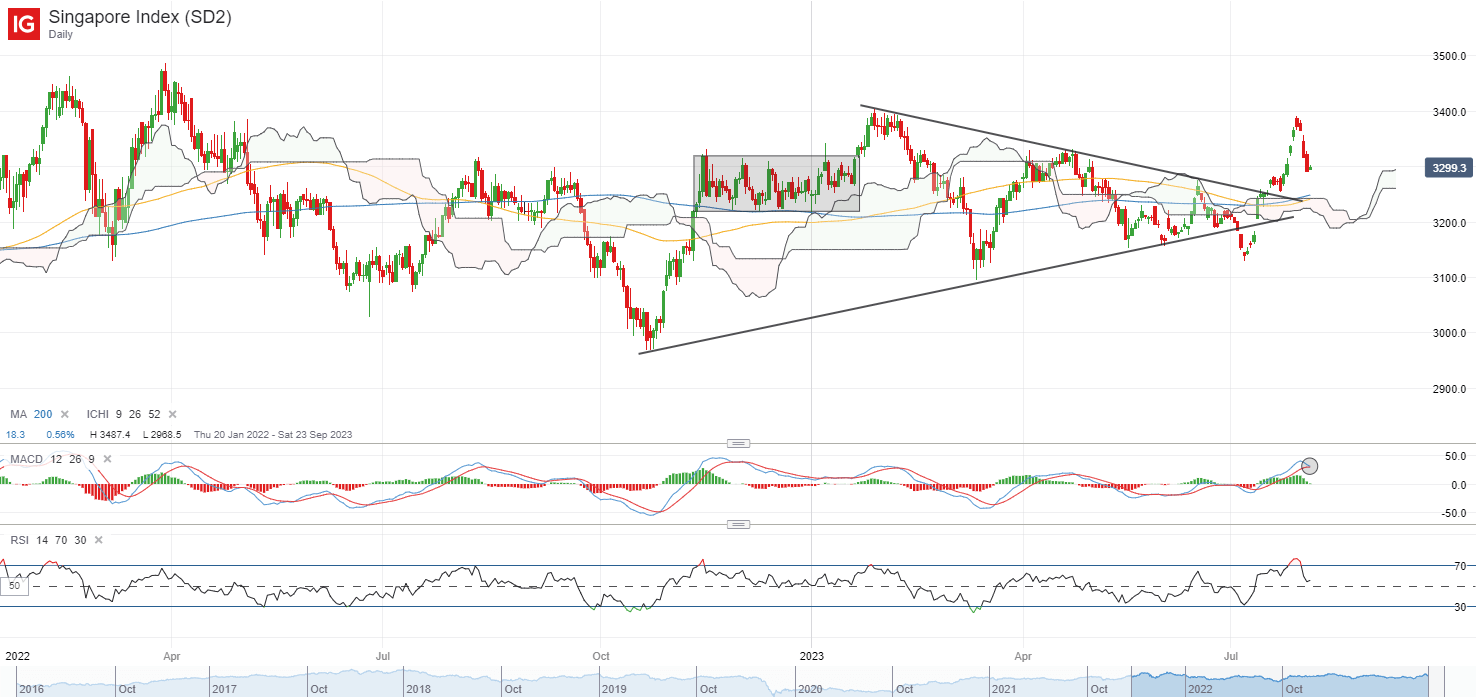

Following an 8% rally in the Straits Times Index since early-July this year, some “sell-the-news” seem to be playing out, with the near-term unwinding leading to the formation of a bearish MACD crossover. Perhaps the key support to put on the radar ahead will be the 3,240 level, where a confluence of its 100-day and 200-day MA stands. The level also marked a previous break of its downward trendline resistance. For now, it could still be a near-term retracement compared to a reversal, with recent sell-off marking the 38.2% Fibonacci retracement level, while its RSI still hangs above its key 50 level.

Source: IG charts

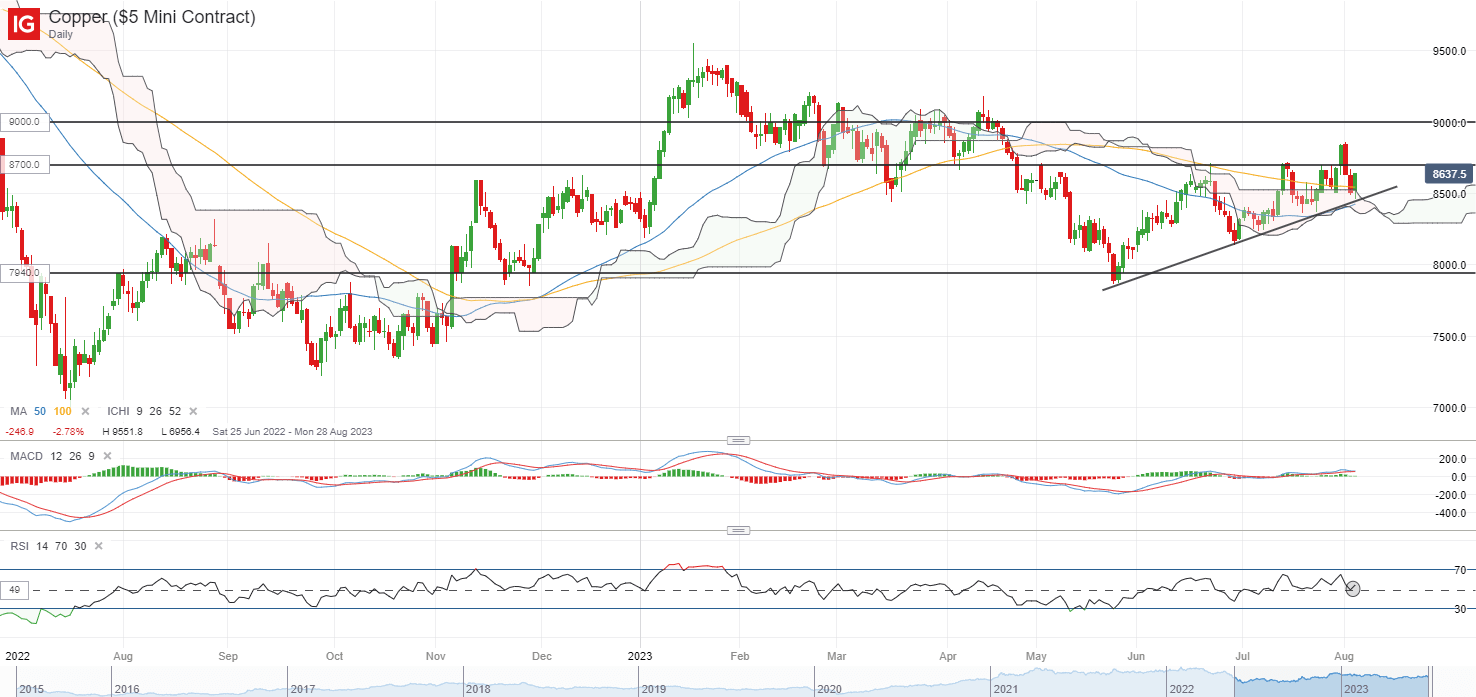

On the watchlist: Copper prices attempting to form higher low off trendline support

Downbeat economic data out of China and a firmer US dollar have led copper prices to retrace by around 4% this week, but the near-term upward trend remains intact for now with an attempt to form a higher low on the daily chart yesterday. This follows after a retest of a support confluence (upward trendline support, 50-day moving average) at the US$8,460/tonne level was met with some dip-buying, with buyers defending the key 50 level on its daily relative strength index (RSI) thus far.

The US$8,700/tonne level may stand as immediate resistance to overcome. Reclaiming this level may pave the way to retest the US$9,000/tonne level next, with any formation of a new higher high on watch to reinforce the prevailing upward trend.

Recommended by Jun Rong Yeap

Traits of Successful Traders

Source: IG charts

Thursday: DJIA -0.19%; S&P 500 -0.25%; Nasdaq -0.10%, DAX -0.79%, FTSE -0.43%

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0