US Dollar Slides on Fed Tilt but CPI Fears Linger. Will Treasury Yields Go Lower?

[ad_1] US Dollar, Federal Reserve, FOMC Minutes, USD/CHF, USD/JPY, Treasury Yields – Talking Points The US Dollar is on the backfoot on Fed speak and FOMC minutes Treasury yields might have assisted the Fed but that picture could change PPI beat forecasts and attention now turns to CPI. Will it move the US Dollar? Recommended

[ad_1]

US Dollar, Federal Reserve, FOMC Minutes, USD/CHF, USD/JPY, Treasury Yields – Talking Points

- The US Dollar is on the backfoot on Fed speak and FOMC minutes

- Treasury yields might have assisted the Fed but that picture could change

- PPI beat forecasts and attention now turns to CPI. Will it move the US Dollar?

Recommended by Daniel McCarthy

Get Your Free USD Forecast

The US Dollar has been struggling this week against the Euro, Sterling and Swiss Franc but it has faired better against the Yen and commodity-linked currencies.

Undermining the outlook for the ‘big dollar’ has been the notable tilt in the stance of the Federal Reserve.

Until this week, the debate had been symmetrically focussed on a hike or no hike scenario for the next Federal Open Market Committee (FOMC) meeting.

However, in the last few days, the market has seen a shift toward the risks for policy going forward being balanced and this has opened the prospect of a potential cut at some stage further down the track.

The less hawkish rhetoric started on Monday from several Fed speakers and has continued into the middle of the week, culminating with the release of the FOMC meeting minutes from the September conclave overnight.

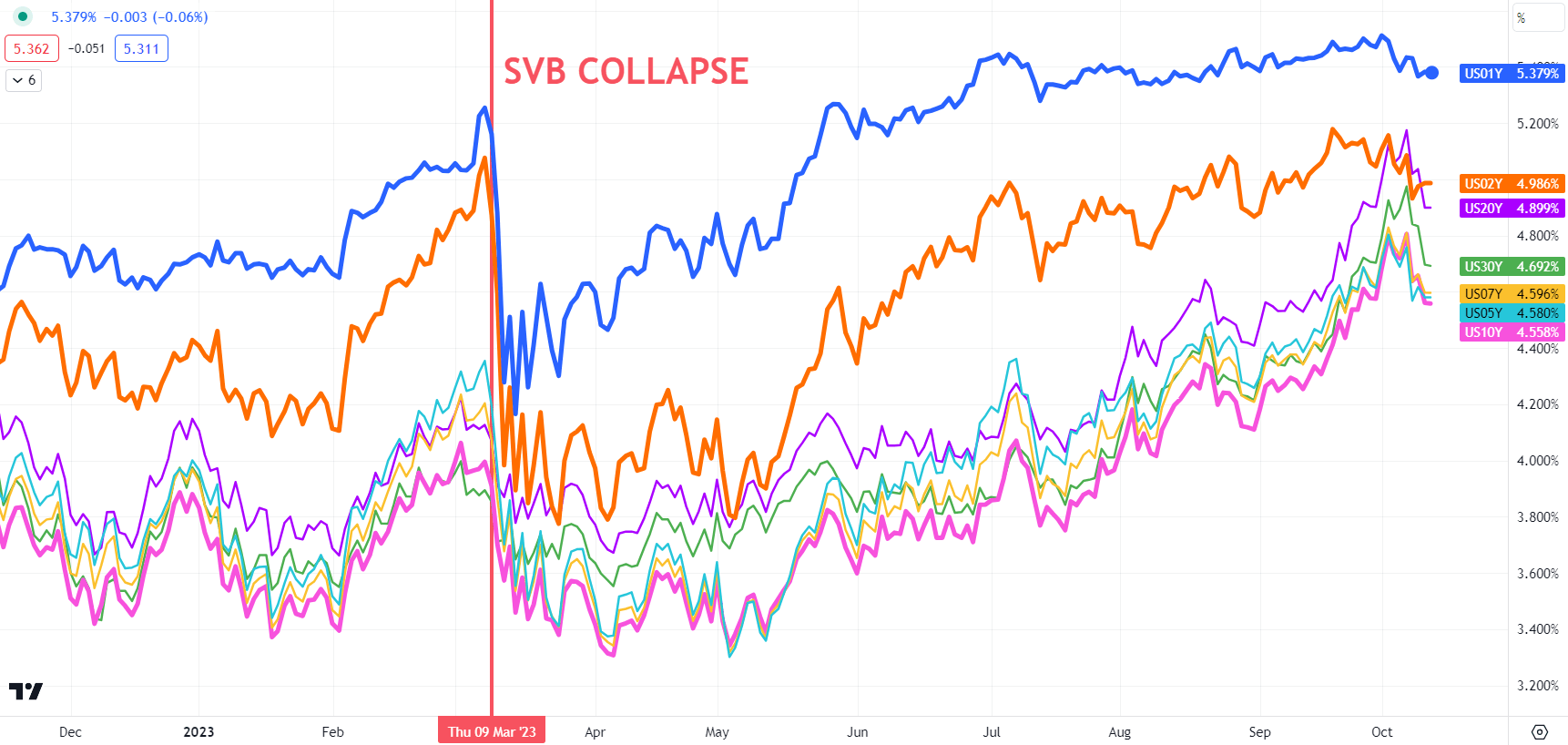

The commentary from Fed members Jefferson, Logan, Kashkari and Daly, among others, pointed to the higher yields at the back end of the Treasury curve effectively doing some of the desired tightening for the Fed without them having to raise the short-end target rate.

The benchmark 10-year bond nudged 4.88% last Friday, the highest return for the low-risk asset since 2007. It collapsed to trade below 4.55% overnight and remains near that level at the time of going to print, potentially undoing some of the Fed’s desired tightening.

Recommended by Daniel McCarthy

Traits of Successful Traders

From the FOMC minutes released yesterday, the statement specifically said, “Participants generally judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the Committee’s goals had become more two-sided.”

With the Fed appearing to signal a reluctance to hike and the tumbling of Treasury yields, not surprisingly, the US Dollar has been languishing against most of the major currencies.

The Swiss Franc has seen the largest gains this week reversing the moves of last week when USD/CHF made a seven-month high.

A benign inflation environment there has allowed the Swiss National Bank (SNB) to refrain from aggressive monetary policy tightening.

Its target rate of 1.75% is well below that of the other major central banks other than the Bank of Japan (BoJ), which has a negative interest rate policy (NIRP).

US PPI data overnight came in hotter than expected at 2.2% year-on-year to the end of September against 1.6% anticipated.

Later today the focus will be on US CPI but it appears that it would take a large miss to reshape the market’s outlook for the Fed’s rate path.

A Bloomberg survey of economists is estimating that year-on-year headline CPI will be 3.7% to the end of September. To learn more about trading the news, click on the banner below.

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

TREASURY YIELDS ACROSS THE CURVE

Chart created in TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0