US Dollar Rallies on Soaring Yields, USD/JPY Rockets Higher, Eyeing 2023 Peak

[ad_1] US DOLLAR FORECAST The U.S. dollar, as measured by the DXY index, continues its impressive rebound, gaining strength from the surge in U.S. Treasury rates The rise in bond yields has a positive impact on USD/JPY, propelling the currency pair to its highest levels in almost four weeks. Market focus remains on the highly

[ad_1]

US DOLLAR FORECAST

- The U.S. dollar, as measured by the DXY index, continues its impressive rebound, gaining strength from the surge in U.S. Treasury rates

- The rise in bond yields has a positive impact on USD/JPY, propelling the currency pair to its highest levels in almost four weeks.

- Market focus remains on the highly anticipated U.S. jobs report, which is scheduled to be released later in the week.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: S&P 500, Nasdaq 100 Forecast – Apple and Amazon Earnings Eyed Before US Jobs Data

The U.S. dollar, measured by the DXY index, climbed on Tuesday, marking its fourth consecutive trading session of gains and reaching its best levels since July 10 (DXY: +0.52% to 102.40). This advance was driven primarily by rising U.S. Treasury yields, with the 10-year note topping 4.0% and approaching the peak observed last month.

Encouraging U.S. economic data recently, including second-quarter GDP and consistently low unemployment claims, have boosted bets that the country will avoid a recession altogether in 2023 and possibly in 2024. This could mean further policy firming and higher rates for longer, especially if demand pressures prevent inflation from quickly converging to the 2.0% target.

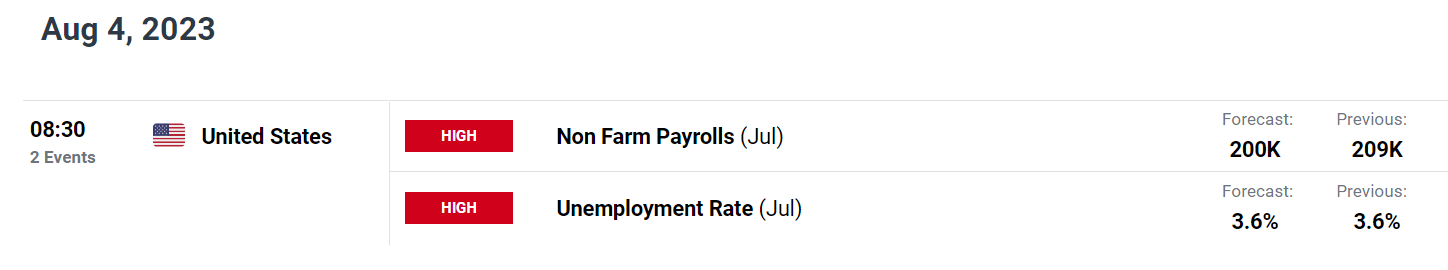

In any case, additional insights into the broader outlook will come to light on Friday with the release of the U.S. Bureau of Labor Statistics’ July nonfarm payrolls survey. The consensus estimates indicate that U.S. employers added 200,000 workers last month, following an increase of 209,000 positions in June.

Recommended by Diego Colman

Get Your Free USD Forecast

UPCOMING US ECONOMIC DATA

Source: DailyFX Economic Calendar

A headline print that closely aligns with market projections is likely to have a neutral effect on the U.S. dollar. However, a significant deviation on the upside, for instance, job figures surpassing 300,000, could be bullish for the greenback by driving interest rate expectations in a more hawkish direction.

Conversely, a weak NFP report, like employment gains below 150,000, might exert downward pressure on the greenback, leading traders to speculate that the July FOMC hike was the last of the ongoing tightening campaign and that the bank will remain on hold going forward before finally pivoting in early 2024. This scenario could have a positive impact on currencies such as the euro, the yen and the pound.

Recommended by Diego Colman

Get Your Free JPY Forecast

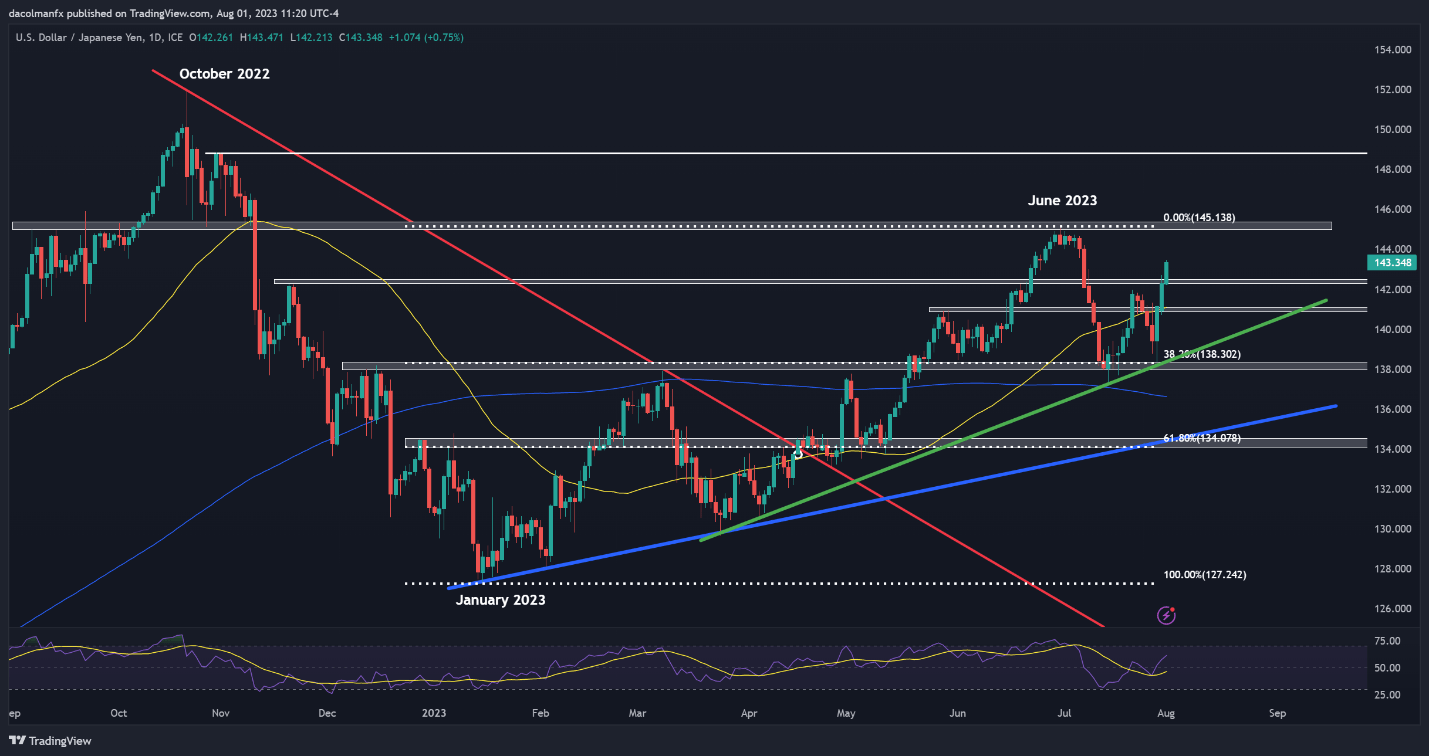

USD/JPY TECHNICAL ANALYSIS

USD/JPY soared on Tuesday, hitting to its strongest level in nearly four-weeks. The Bank of Japan’s recent decision to make adjustments to its yield curve control program proved to be a short-lived source of strength for the yen as markets concluded that the central bank has not significantly altered its ultra-loose stance.

With the U.S. dollar regaining its poise, there is potential for the pair to continue its upward trajectory, with the next technical resistance seen around 145.14. In the event of a bullish breakout, bullish momentum could gather pace, setting the stage for a rally toward 148.85.

On the flip side, if sellers return and spark a bearish reversal, initial support appears at 142.40, followed by 141.00. On further weakness, we could see a move towards short-term trendline support at 138.30, which also aligns with the 38.2% Fibonacci retracement of the January/June advance.

USD/JPY TECHNICAL ANALYSIS

USD/JPY Chart Prepared Using TradingView

Recommended by Diego Colman

How to Trade USD/JPY

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0