US Dollar on the Ropes with Yen Leading the Way. AUD, NZD and GBP Piled In

[ad_1] US Dollar, DXY Index, USD/JPY, Ueda, BoJ, USD/CNH, China, India, Commodities – Talking Points US Dollar is under pressure as BoJ Governor’s Comments Shake Currency Markets Government bond yields are higher globally with JGBs leading the way The ascending trend remains in play for the DXY index for now. Will it reverse? Recommended by

[ad_1]

US Dollar, DXY Index, USD/JPY, Ueda, BoJ, USD/CNH, China, India, Commodities – Talking Points

- US Dollar is under pressure as BoJ Governor’s Comments Shake Currency Markets

- Government bond yields are higher globally with JGBs leading the way

- The ascending trend remains in play for the DXY index for now. Will it reverse?

Recommended by Daniel McCarthy

Introduction to Forex News Trading

The US Dollar has taken a battering across the board to start Monday with the DXY (USD) index giving up a large portion of last week’s gains.

The Japanese Yen scored the largest gains in the aftermath of comments by the Bank of Japan (BoJ) Governor.

In an interview with the Yomiuri Shimbun newspaper, Governor Kazuo Ueda said, “We have a variety of options if economic and price conditions turn upward.”

However, he clarified that “There is still some way to go before the price target can be realized. We will continue our persistent monetary easing policy.”

USD/JPY initially traded near the recent peak of 147.87 at the open before collapsing toward 146.00 throughout the Asian session. 10-year Japanese Government Bond yields traded above 0.70% today for the first time since early 2014.

Elsewhere, the G-20 summit concluded in India, with a joint communique that has been viewed as a positive for India, indicating a possible shift in global geo-political and economic dynamics.

China’s credit data exceeded expectations, leading to a dip in the USD/CNH (US Dollar/Chinese Yuan) after the fix. New Yuan loans were CNY 1.36 billion in August, above forecasts of CNY 1.25 billion.

This news could be a positive signal for traders, as a healthier credit environment in China can potentially lead to increased economic activity and investment opportunities.

The growth linked Aussie and Kiwi Dollars notched sizable gains, as did Sterling do a lesser extent.

APAC equity indices are mixed with Australia’s ASX 200 and mainland China’s CSI 300 seeing small gains while Hong Kong’s Hang Seng index dipped.

In Japan, bank shares experienced noticeable gains with the prospect of higher interest rates. The Nikkei 500 banking index rose by over 3%, while the broader Nikkei 225 index fell by approximately 0.5%.

This divergence highlights the potential for sector-specific trading strategies, as different industries can react differently to the same macroeconomic indicators.

In commodities markets, iron ore futures traded higher on the Dalian and Singaporean exchanges. Gold and silver have seen small gains on the weaker USD.

Crude oil is mostly steady with the West Texas Intermediate (WTI) futures contract slipping slightly toward US$ 87 while the Brent contract is trading near Friday’s close just above US$ 90.50.

Looking ahead, the highlight this week will be the US Consumer Price Index (CPI) data release on Wednesday. This key economic indicator can significantly influence the Federal Reserve’s monetary policy, and thus impact the USD and other correlated assets.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade EUR/USD

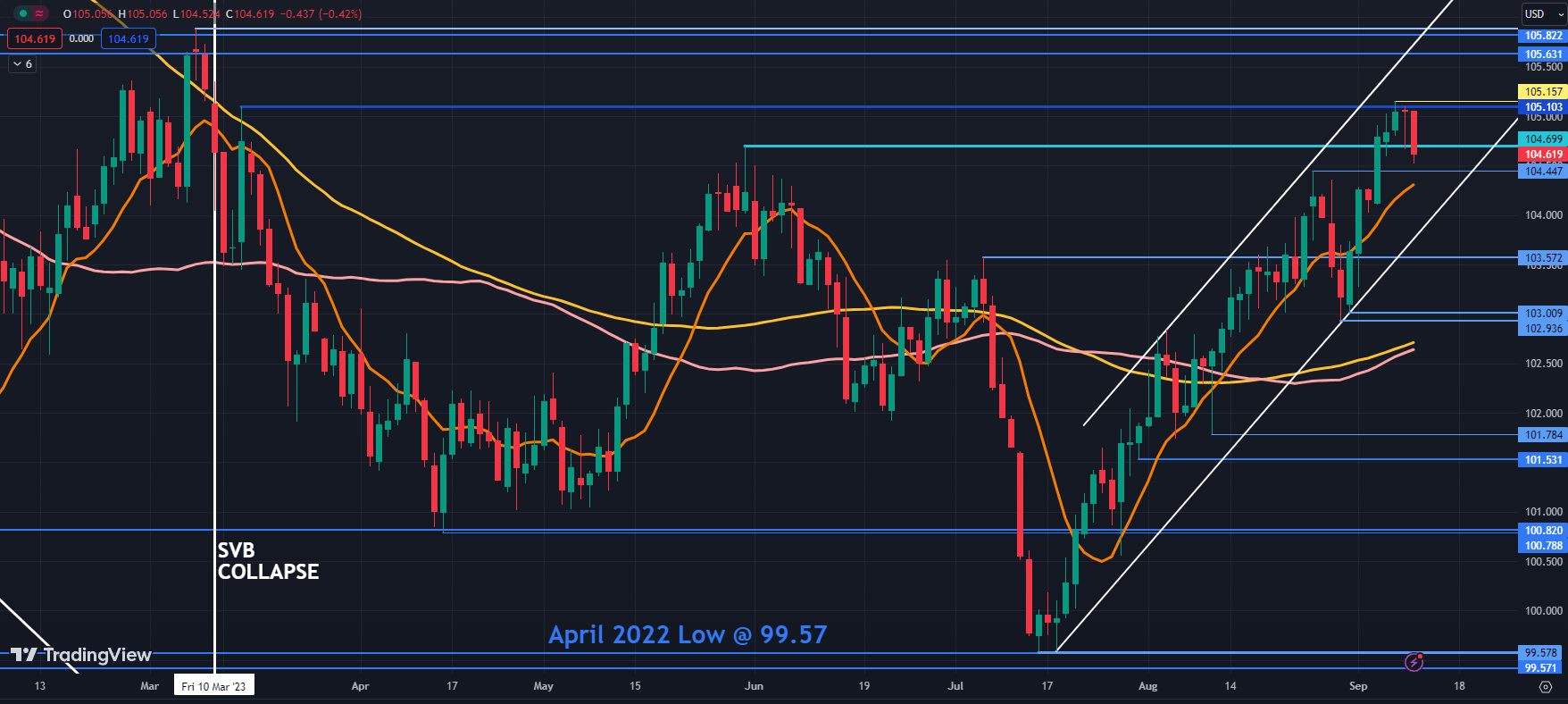

DXY (USD) INDEX TECHNICAL ANALYSIS SNAPSHOT

The DXY Index broke below a breakpoint near 104.70 and that level may offer resistance ahead of another breakpoint and prior peak in the 105.10 – 105.15 area.

The index remains in an ascending trend channel and support might be found at the breakpoints near 104.45 and 103.57 or further below at the previous lows in the 102.90 – 103.00 area.

Chart created in TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0