US Dollar, Dow Jones Sink as Fitch Downgrades US Credit Rating. Now What?

[ad_1] US Dollar, Dow Jones, Fitch US Credit Ratings Downgrade – Market Update: US Dollar, Dow Jones fall after Fitch lowers US credit rating Fiscal deficits, social security, aging population woes outlined Financial markets turn risk-averse heading to Wednesday trade Recommended by Daniel Dubrovsky Get Your Free USD Forecast The US Dollar, Dow Jones, S&P

[ad_1]

US Dollar, Dow Jones, Fitch US Credit Ratings Downgrade – Market Update:

- US Dollar, Dow Jones fall after Fitch lowers US credit rating

- Fiscal deficits, social security, aging population woes outlined

- Financial markets turn risk-averse heading to Wednesday trade

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

The US Dollar, Dow Jones, S&P 500 and Nasdaq 100 fell after reports crossed the wires that Fitch, a key credit rating agency, downgraded the US score to AA+ from AAA. This partly reflected the “expected fiscal deterioration over the next three years”. Furthermore, Fitch also mentioned that there have been “only limited progress in tackling medium-term challenges related to rising social security and Medicare costs”.

The latter two are of key importance due to the country’s aging population. According to the Congressional Budget Office (CBO), growth of the population age 65 or more is seen outpacing gains of younger cohorts, resulting in ageing demographics. This makes it difficult to sustain a system in which funding comes from prime-age participants.

For financial markets, this has not been the first episode of a US credit ratings downgrade. In the past, we have seen similar reactions from equities. But, these were often short-lived. This time around, the difference is that rising interest rates have been increasing the cost of debt. The CBO projects that annual net interest costs would almost double over the upcoming decade.

Meanwhile, it seems there is little appetite from Congress to conduct fiscal austerity, which is the function of reducing government spending or raising taxes to reduce deficits. Effectively, this functions similarly to monetary tightening, helping to slow an economy when it is appropriate. But, the CBO projects that the budget deficit is expected to increase towards 7% of GDP in 2033 from 5.3%.

It will remain to be seen how this impacts Wall Street down the road. A ratings downgrade would likely push up government debt costs further from already rising levels. In some ways, this could even deter the Federal Reserve from raising rates further. In the meantime, the decline in Wall Street futures could spell a risk-averse session for Asia-Pacific markets heading into Wednesday’s trading session.

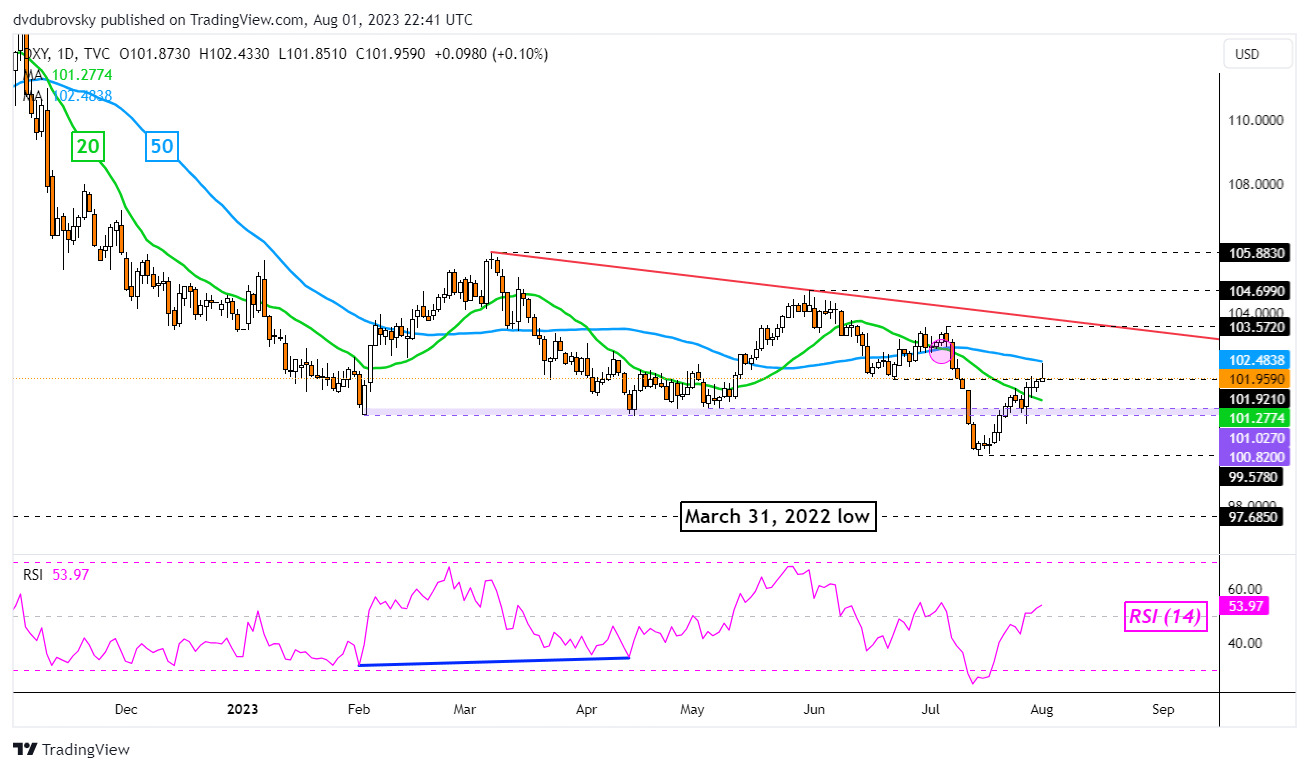

US Dollar Technical Analysis

The US Dollar has rejected the 50-day Moving Average (MA) after the latter held as resistance. But, the DXY remains above the 100.82 – 101.02 inflection zone. In the event of further downside progress, keep a close eye on this zone for key support. Otherwise, extending higher places the focus on falling resistance from March.

DXY Daily Chart

Chart Created in TradingView

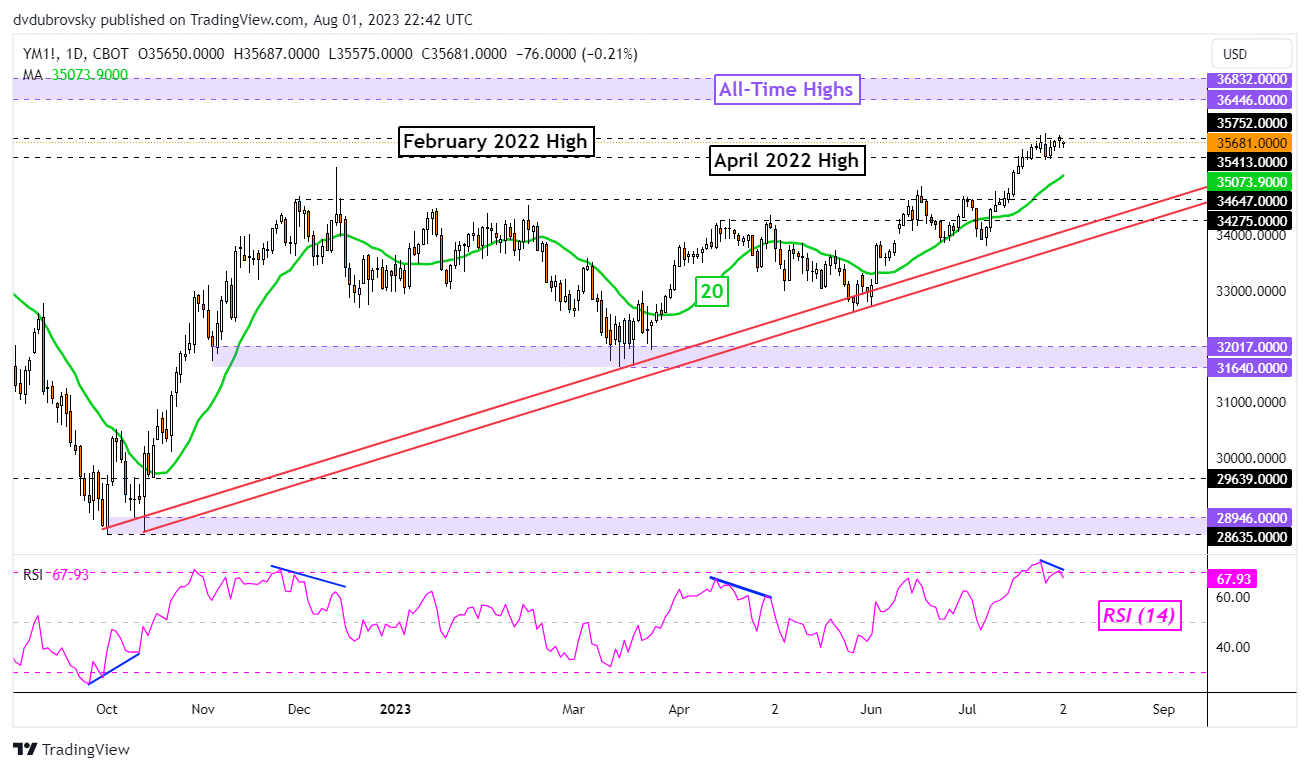

Dow Jones Technical Analysis

Meanwhile, the Dow Jones is sitting just under the February 2022 high of 35752. A rejection of this resistance could send prices down toward the 20-day MA. This could hold as support, maintaining the upside bias. Broadly speaking, rising support from October is still guiding the Dow Jones upward. It would take a series of losses to overturn the bullish technical landscape.

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Dow Jones Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0