US Dollar, British Pound, Euro, Key Inflation Gauge, German CPI

[ad_1] Recommended by Daniel Dubrovsky How to Trade EUR/USD The US Dollar experienced mixed performance against its major peers this past week. Looking at the chart below, the British Pound was the worst performer weakening about -1.2%. Meanwhile, the New Zealand Dollar was better off, rallying around 1.1%. Meanwhile, Wall Street took a plunge in

[ad_1]

Recommended by Daniel Dubrovsky

How to Trade EUR/USD

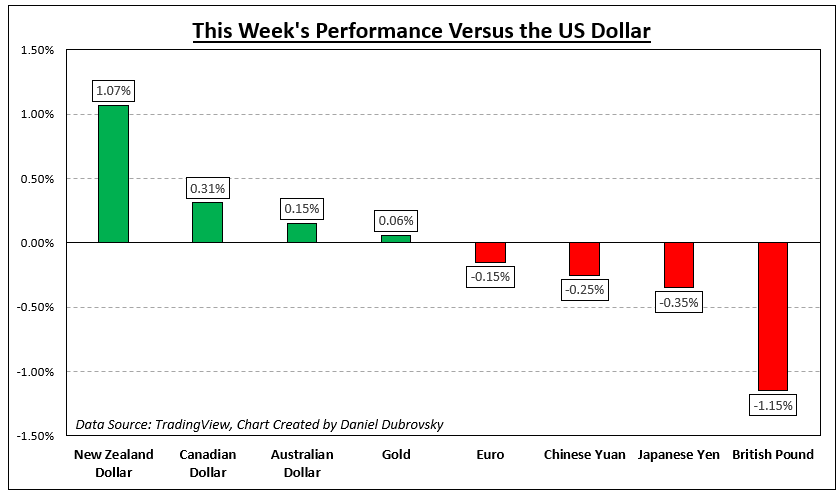

The US Dollar experienced mixed performance against its major peers this past week. Looking at the chart below, the British Pound was the worst performer weakening about -1.2%. Meanwhile, the New Zealand Dollar was better off, rallying around 1.1%.

Meanwhile, Wall Street took a plunge in the aftermath of the Federal Reserve monetary policy announcement. The Dow Jones, S&P 500 and Nasdaq Composited fell -1.9%, -2.9% and -3.6%, respectively.

The central bank’s pursuit to bring inflation down is now primarily coming in the form of pushing up expectations of a higher terminal rate. In other words, policymakers are seeing a scenario where interest rates stay higher for longer.

As such, we saw the 10-year Treasury yield surge 2.4% this past week, closing at the highest since late 2007. This also pushed up 30-year mortgage rates, further contributing to a general rise in borrowing costs as quantitative tightening continued.

Key event risk next week includes the Fed’s preferred inflation gauge, German inflation data, Chinese manufacturing PMI, and more. What else is in store for financial markets in the week ahead?

Recommended by Daniel Dubrovsky

How to Trade USD/JPY

How Markets Performed – Week of 9/18

Forecasts:

British Pound Weekly Forecast: Respite Unlikely As Fundamentals Wilt

Sterling has lost a sizeable amount of fundamental support with the Bank of England holding rates steady. Worsening fundamentals point to an extended selloff.

Gold (XAU/USD), Silver (XAG/USD) Forecast: Upside Potential but Technical Hurdles Lie Ahead

Gold and Silver managed to recover toward the end of the week despite broad-based US Dollar strength. Further upside looks likely, but a host of technical hurdles may prove a difficult hurdle for the commodities to navigate.

Euro Forecast: EUR/USD on Breakdown Watch, EUR/GBP Stuck in No Man’s Land For Now

This article offers an in-depth analysis of EUR/USD and EUR/GBP from a fundamental and technical standpoint, exploring pivotal factors likely to influence price movements in upcoming trading sessions.

Japanese Yen Forecast: BoJ’s Dovishness Puts USD/JPY Channel Breakout in Play

USD/JPY rallies heading into the weekend following Bank of Japan’s dovish monetary policy announcement. As prices approach channel resistance, the pair’s reaction could offer key insight into the near-term outlook.

S&P 500, Dow Jones Forecast: Fed Rate Path Weighs on Equities

The Fed’s commitment to the ‘higher for longer’ narrative sent risk assets sharply lower as investors digest what this could mean for expensive US stocks.

US Dollar Technical Weekly Outlook: EUR/USD, GBP/USD in Focus as Downtrends Continue

The US Dollar remains in a firmly bullish posture against its major counterparts. What are key levels to watch for in EUR/USD and GBP/USD in the week ahead?

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0