US Dollar, S&P 500, Trendlines – Technical Update:

- US Dollar eyeing 5th weekly gain, S&P 500 faces 3rd weekly loss

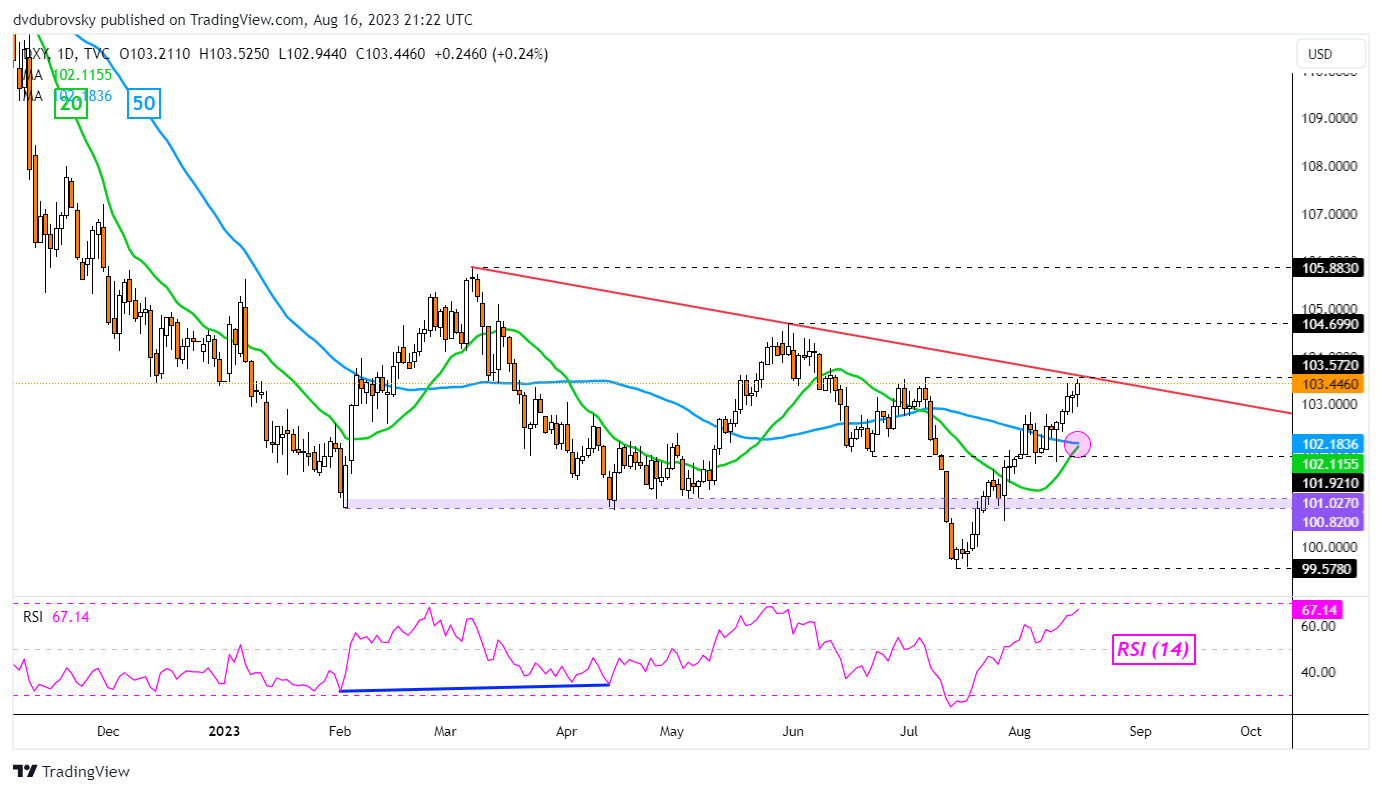

- DXY Dollar Index facing key falling trendline, will the latter hold?

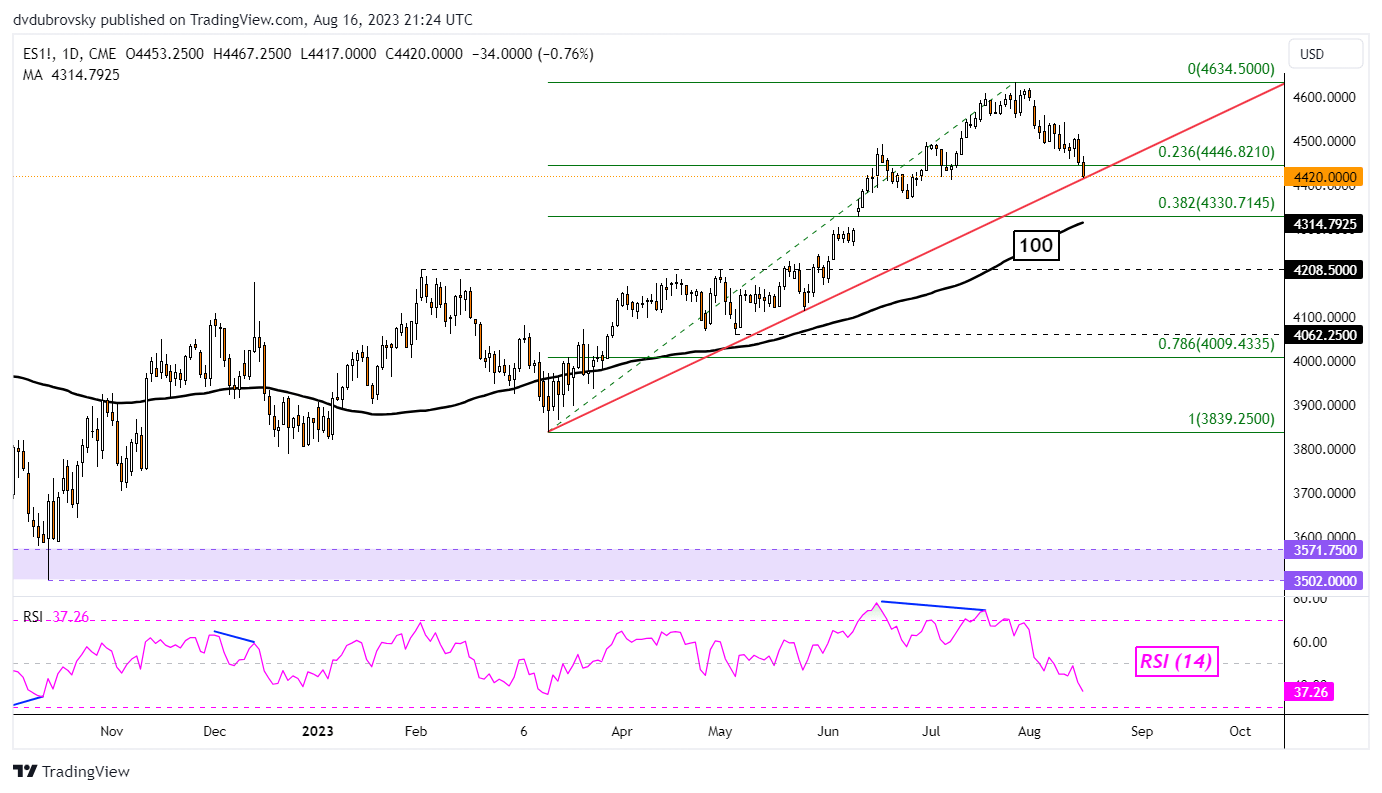

- Meanwhile, the S&P 500 is looking to key rising support from March

Recommended by Daniel Dubrovsky

What is the outlook for the US Dollar?

The US Dollar extended its winning streak over the past 24 hours. So far this week, the DXY Dollar Index is up about 0.6 percent, aiming for a 5th consecutive weekly gain. If confirmed, that would be the longest winning streak since early May 2022. With that in mind, the currency now faces its next critical technical challenge.

DXY now sits just below the key falling trendline from February which has been maintaining the broader downside focus. On top of that, the line is currently closely aligned with the July high of 103.57. As such, this could be a difficult point to breach for bulls.

Still, a bullish Golden Cross is on the verge of forming between the 20- and 50-day Moving Averages (MAs). This is supporting a near-term upside technical bias. Breaking above resistance exposes the May high of 104.69 before the February peak of 105.88 comes into focus. Otherwise, a turn lower places the focus on the MAs for support.

Recommended by Daniel Dubrovsky

What are the fundamentals of breakout trading?

Chart Created in TradingView

Unlike the US Dollar, the S&P 500 has now dropped to key rising support from March. So far this week, the stock market index is down about -1.4 percent. If losses are sustained, this will be the 3rd consecutive weekly loss, the longest losing streak since late February.

Breaking under the trendline, with confirmation, offers an increasingly bearish technical bias. That places the focus on the combination of the 38.2% Fibonacci retracement level of 4330 and the 100-day Moving Average. These may hold as key support, reinstating a broader bullish bias. Otherwise, if the trendline holds here, a pivot higher places the focus on the July high of 4634.

| Change in | Longs | Shorts | OI |

| Daily | 1% | 1% | 1% |

| Weekly | 5% | -2% | 0% |

Chart Created in TradingView

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0