US August ISM manufacturing PMI 47.6 vs 47.0 expected

[ad_1] ISM manufacturing Prior report 46.4 Prices paid 48.4 vs 43.9 expected. Last month 42.6 Employment 48.5 vs 44.2 expected. Last month 44.4 New orders 46.8 vs 47.3 prior Manufacturing has been in a recession for some time but there are some green shoots. I suspect this survey is going to be a mess for

[ad_1]

ISM manufacturing

- Prior report 46.4

- Prices paid 48.4 vs 43.9 expected. Last month 42.6

- Employment 48.5 vs 44.2 expected. Last month 44.4

- New orders 46.8 vs 47.3 prior

Manufacturing has been in a recession for some time but there are some green shoots. I suspect this survey is going to be a mess for the next few months because it looks like an autoworkers strike is coming.

Bonds are selling off on this report, in part because of the jump in prices paid. I don’t think that should have been a surprise given energy prices.

Comments in the ISM report:

- “Further reductions in customer orders due to the economic situation

and also their working down of own inventories. Backlog is dwindling,

but still showing robust revenue.” [Computer & Electronic Products] - “Demand still weak. Customer inventories are getting depleted;

however, we are not seeing a real uptick in demand. General supply

conditions are softening.” [Chemical Products] - “Still seeing a slowdown in orders. We’re continuing to ship to max

capacity, with supply constraints still a real part of our day-to-day

business operations.” [Transportation Equipment] - “Customer orders have softened. This is likely due to customers’

increased confidence in the supply chain, (which) has them reducing

their inventories. Customers are also being pinched with higher interest

rates. Additionally, consumers are feeling their purchasing power

eroded by stubbornly high inflation, so they are purchasing less.”

[Food, Beverage & Tobacco Products] - “Fourth quarter orders falling short of projection and indicating a

slowdown in customer demand, though the first quarter forecast remains

solid. Unclear if this is an inventory correction. Logistics stabilized

and costs are matching 2019. Shortages limited to only a few items now,

but suppliers are hesitant to add or replace labor needed in light of

slowing demand.” [Fabricated Metal Products] - “General slowdown in business at the end of the third quarter. For

capital equipment additions, our customers are buying only what they

need for specific jobs and not adding any capital fleet material for

potential future work.” [Machinery] - “There is additional softening in the market. Customers are hesitant

to provide extended forecasts with today’s economic uncertainty.”

[Electrical Equipment, Appliances & Components] - “Business continues to remain strong with sales and profits both

ahead of plan. The bookings were below what we planned, but that was

expected due to fewer working days and summer vacations.” [Miscellaneous

Manufacturing] - “The manufacturing sector continues to be slow, and the low market

prices make it difficult to stay profitable. On the positive side,

laborers are showing enthusiastic employment interest. Rising energy and

fuel prices are of concern to our company.” [Paper Products] - “Business is beginning to improve moderately. Still well below 2022

levels, but it appears that the ‘great inventory rebalancing’ is finally

coming to fruition.” [Plastics & Rubber Products] - “Automotive volume remains strong in preparation for the United Auto

Workers’ potential strike at Ford, General Motors and Stellantis.

Contingency plans in place for sub-tiers. Continue to have issues

recruiting general labor employees. Operational efficiency suffering due

to a lack of human resources. Order book remains strong and ahead of

2022.” [Primary Metals] - “(The Federal Reserve’s) actions to increase borrowing costs has

dampened demand for residential investment. Recently, this slowdown

plateaued somewhat, with demand stabilizing. The outlook for 2024

remains uncertain, and we continue to be cautious about building

inventories.” [Wood Products]

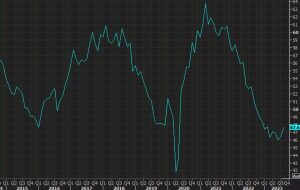

The inventories metric is an interesting one as it makes new lows:

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

برچسب ها :August ، expected ، ISM ، Manufacturing ، PMI

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0