Understanding Forex Market Cycles Analysis Made Simple

[ad_1] Do you struggle to guess when to trade currencies? Forex traders often find it hard to time their trades right. The currency markets can be very unpredictable, leading to missed chances and big losses. But, there’s a way to get better: using forex market cycles analysis. This tool helps traders find when to switch

[ad_1]

Do you struggle to guess when to trade currencies? Forex traders often find it hard to time their trades right. The currency markets can be very unpredictable, leading to missed chances and big losses. But, there’s a way to get better: using forex market cycles analysis.

This tool helps traders find when to switch directions, figure out where the market is going, and aim for profits. By learning about these cycles, you can trade currencies more confidently and accurately.

Studying patterns in financial markets is key to currency analysis. These patterns, or market cycles, can last from a few months to years. By spotting these cycles, traders can make smarter choices about when to buy or sell. This method mixes technical analysis with an understanding of market psychology, giving a full view of currency market movements.

Key Takeaways

- Forex market cycles help predict currency movements.

- Cycles include four phases: expansion, peak, contraction, and trough.

- Understanding cycles aids in timing trades effectively.

- Cycle analysis combines technical indicators and market psychology.

- Effective cycle analysis can improve trading performance.

What Are Market Cycles in Foreign Exchange Trading

Market cycles are key in forex trading. They shape how currencies move and affect trading choices. Knowing forex cycle analysis helps traders guess market trends.

Definition and Basic Concepts

Forex market cycles are patterns in currency pair prices. They have four phases: accumulation, markup, distribution, and markdown. Each phase shows different market states and trader actions.

Importance of Cyclical Patterns

Knowing market cycle phases helps traders make smart choices. By figuring out the current phase, traders can tweak their plans. For instance, in the accumulation phase, prices calm down after falling, hinting at buying chances.

Types of Market Cycles

Forex cycles differ in length and strength. Short cycles last a few months, while long ones last years. Day traders see many cycles in a week with 15-minute charts. Swing traders might not see a full cycle in weeks.

| Cycle Type | Duration | Trader Focus |

|---|---|---|

| Short-term | Few months | Day traders |

| Medium-term | Several months to a year | Swing traders |

| Long-term | Multiple years | Position traders |

Understanding market cycle phases lets traders make smart moves based on the market. This knowledge is key for winning in forex trading.

The Four Essential Phases of Forex Market Cycles Analysis

Knowing the forex market phases is key to trading success. Cycle analysis helps traders spot trends and make smart choices. Let’s look at the four main phases of forex market cycles.

Accumulation Phase Explained

The accumulation phase starts a new cycle. It’s when the market settles after a drop. Smart investors buy cheap assets, often in currency pairs tied to commodities. This phase can last weeks to months.

Markup Phase Characteristics

Prices start going up in the markup phase. More traders join, feeling positive. Volume goes up, and charts show prices moving up. This phase can be quick, lasting days or weeks.

Distribution Phase Indicators

The distribution phase is when the market peaks. Buying and selling balance out, with high hopes. Stories of success get shared in the media. Traders might use short selling as bearish signs appear.

Markdown Phase Signals

In the markdown phase, sellers win, and prices drop fast. This phase is often quicker than the rise. Many traders hold on, thinking prices will go back up, but they don’t.

| Phase | Duration | Key Characteristics |

|---|---|---|

| Accumulation | Weeks to months | Undervalued assets, insider buying |

| Markup | Days to weeks | Rising prices, increased volume |

| Distribution | Variable | Market peak, balanced trading |

| Markdown | Often rapid | Price decline, increased selling |

Understanding these phases through cycle analysis can boost your trading. Remember, cycle lengths vary, from minutes to years, based on the market and time frame.

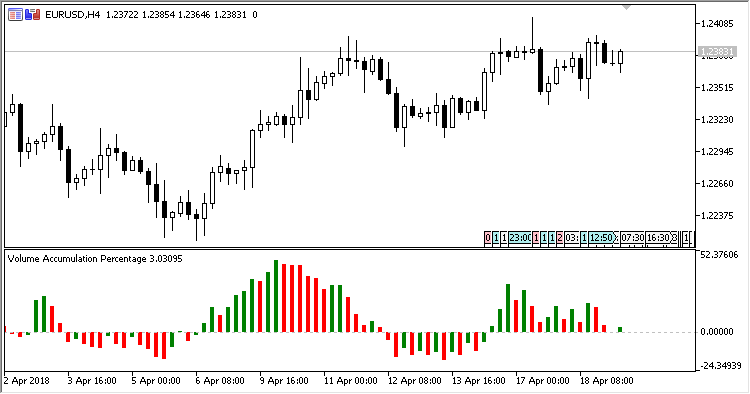

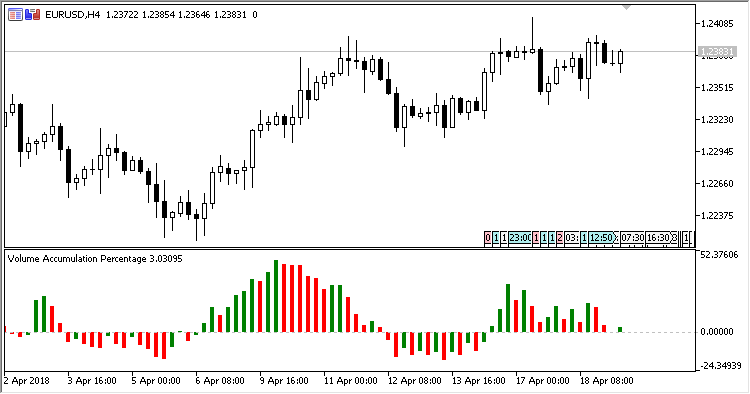

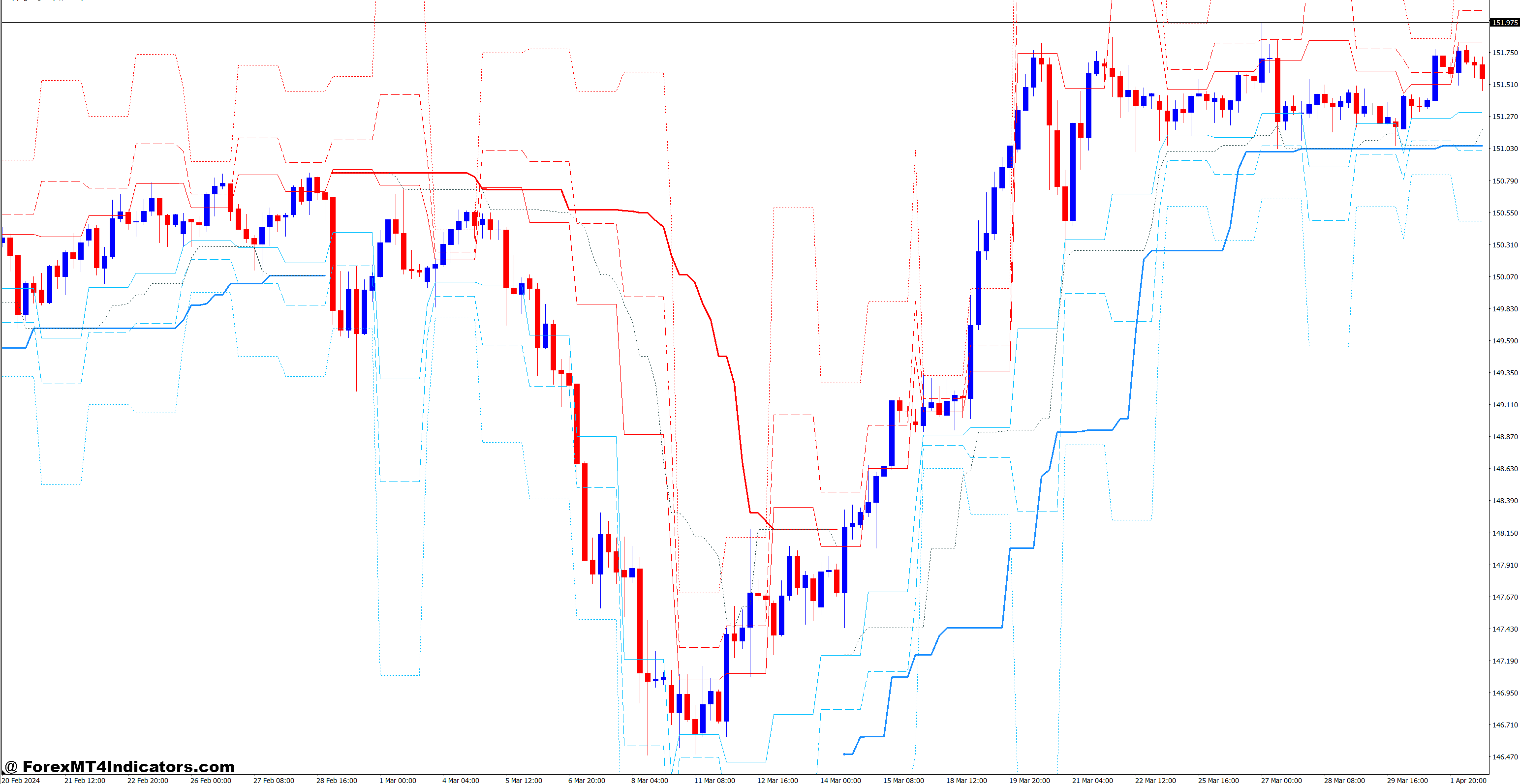

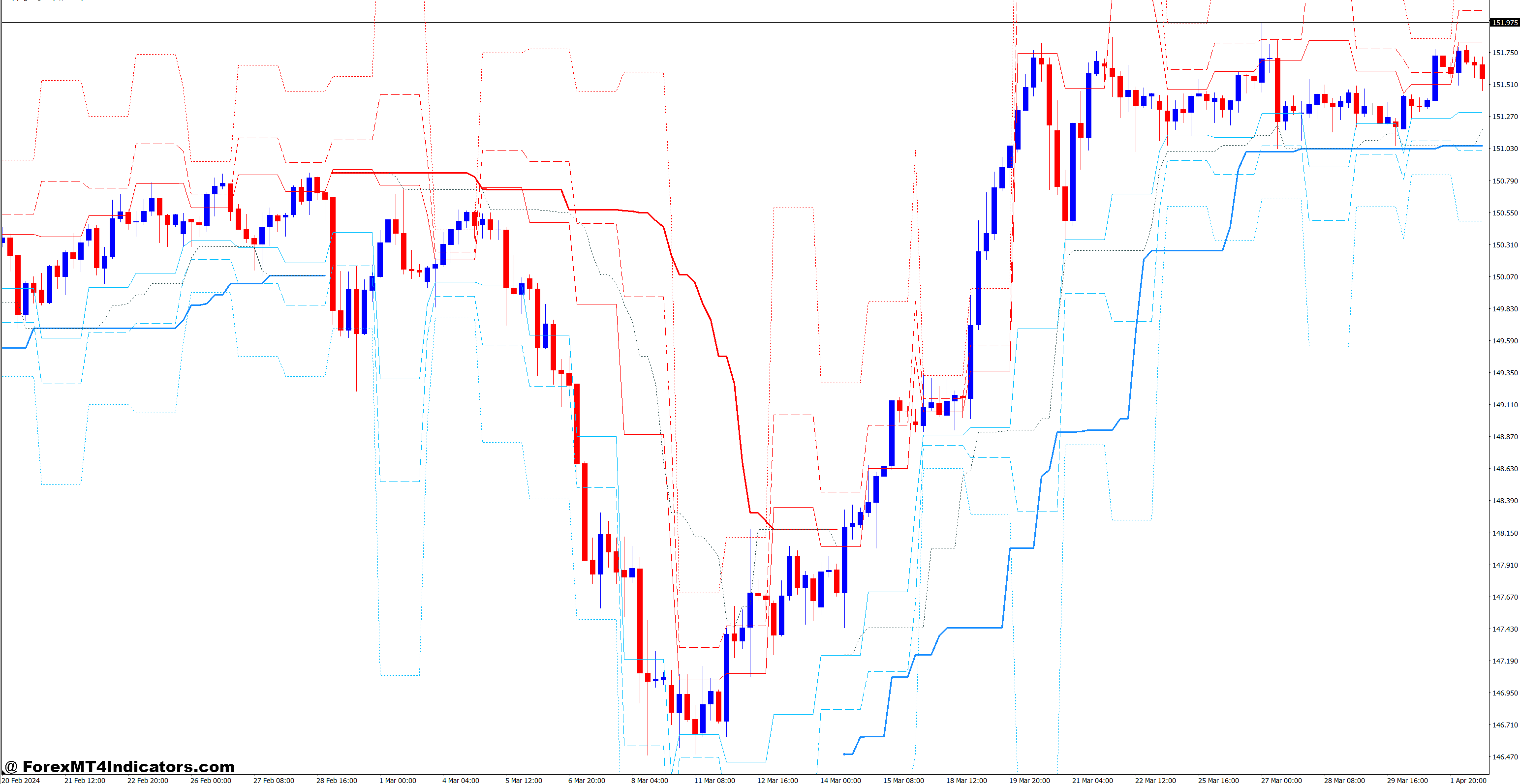

Technical Indicators for Cycle Analysis

Forex technical indicators and cycle analysis tools are key to understanding market patterns. They help traders spot trends, reversals, and the best times to buy or sell.

DeMark Indicators Suite

The DeMark Indicators Suite is a top choice for spotting when markets might turn. It uses price action to forecast market changes. This gives traders a better chance to make smart choices.

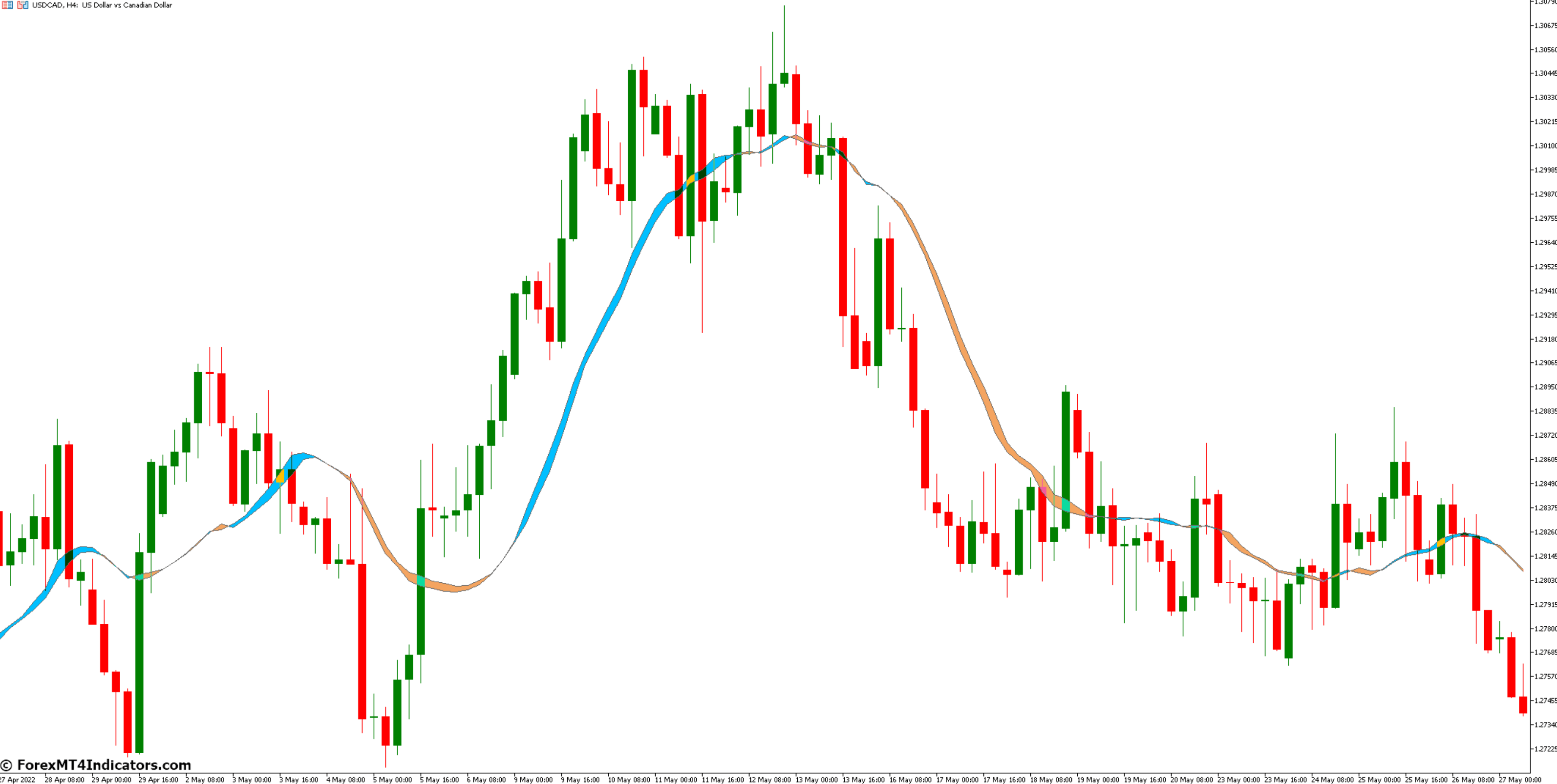

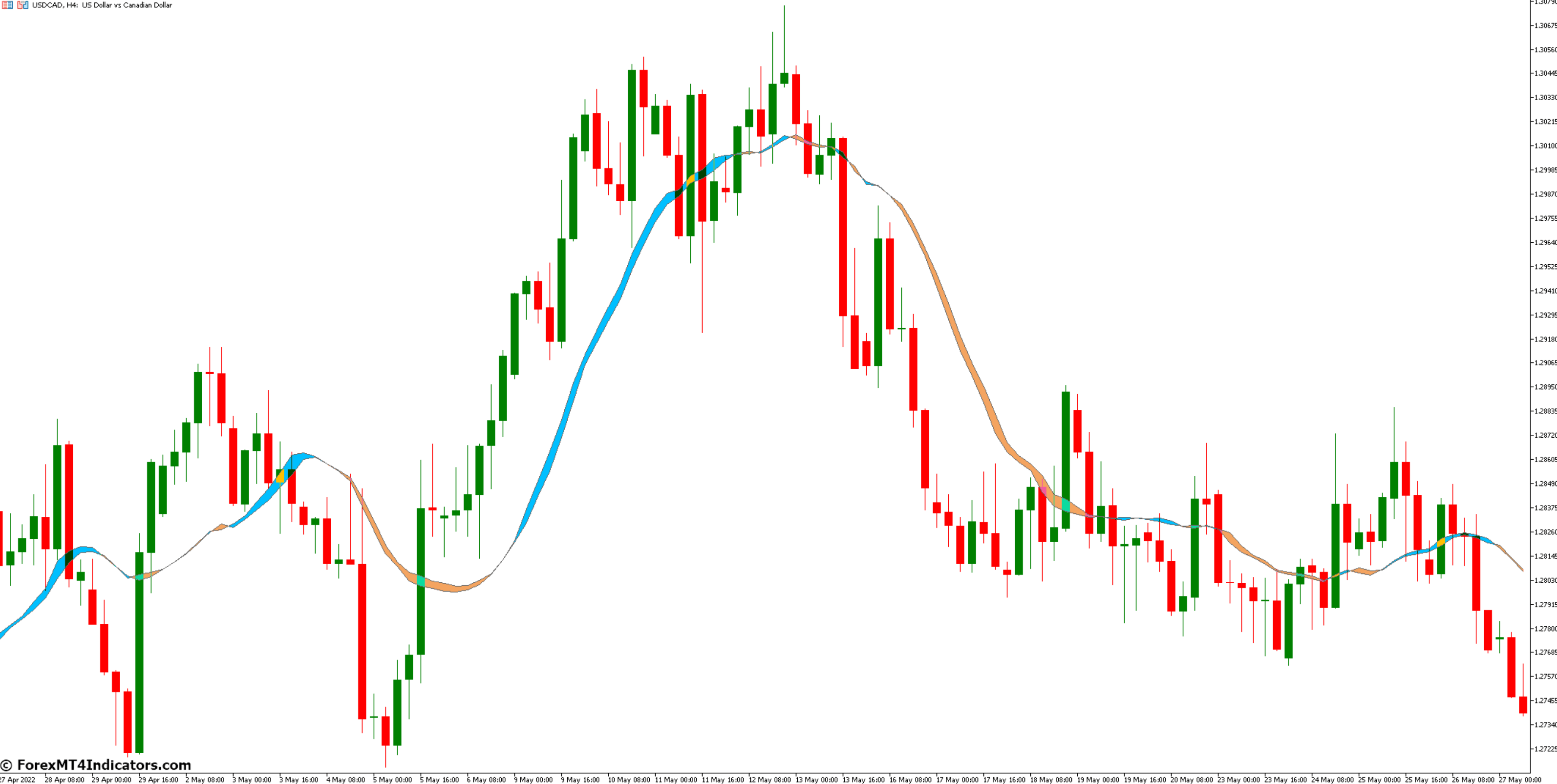

Moving Average Applications

Moving averages are great for showing trend strength. They smooth out price data into a single line. This makes it easier to see where the market is headed. Traders often use moving averages to find support and resistance.

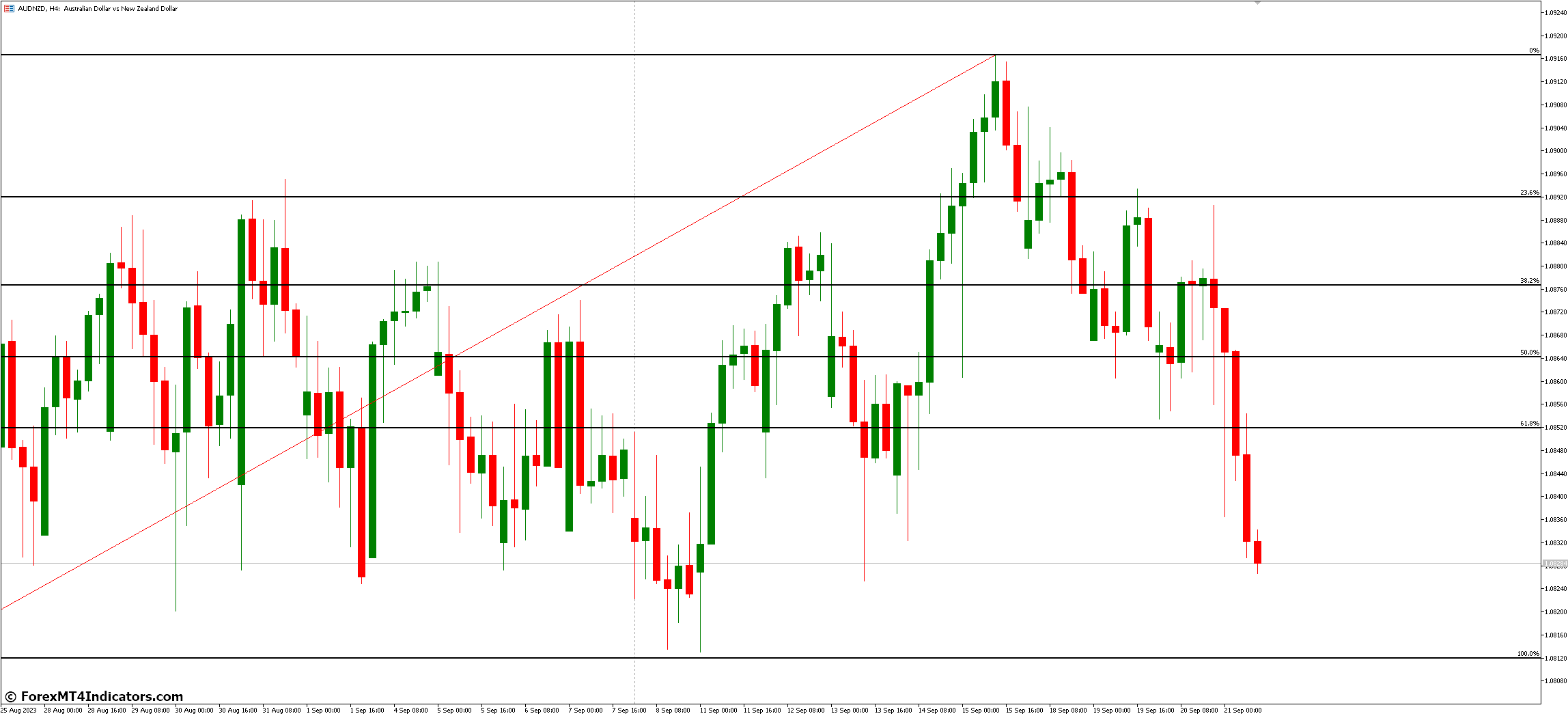

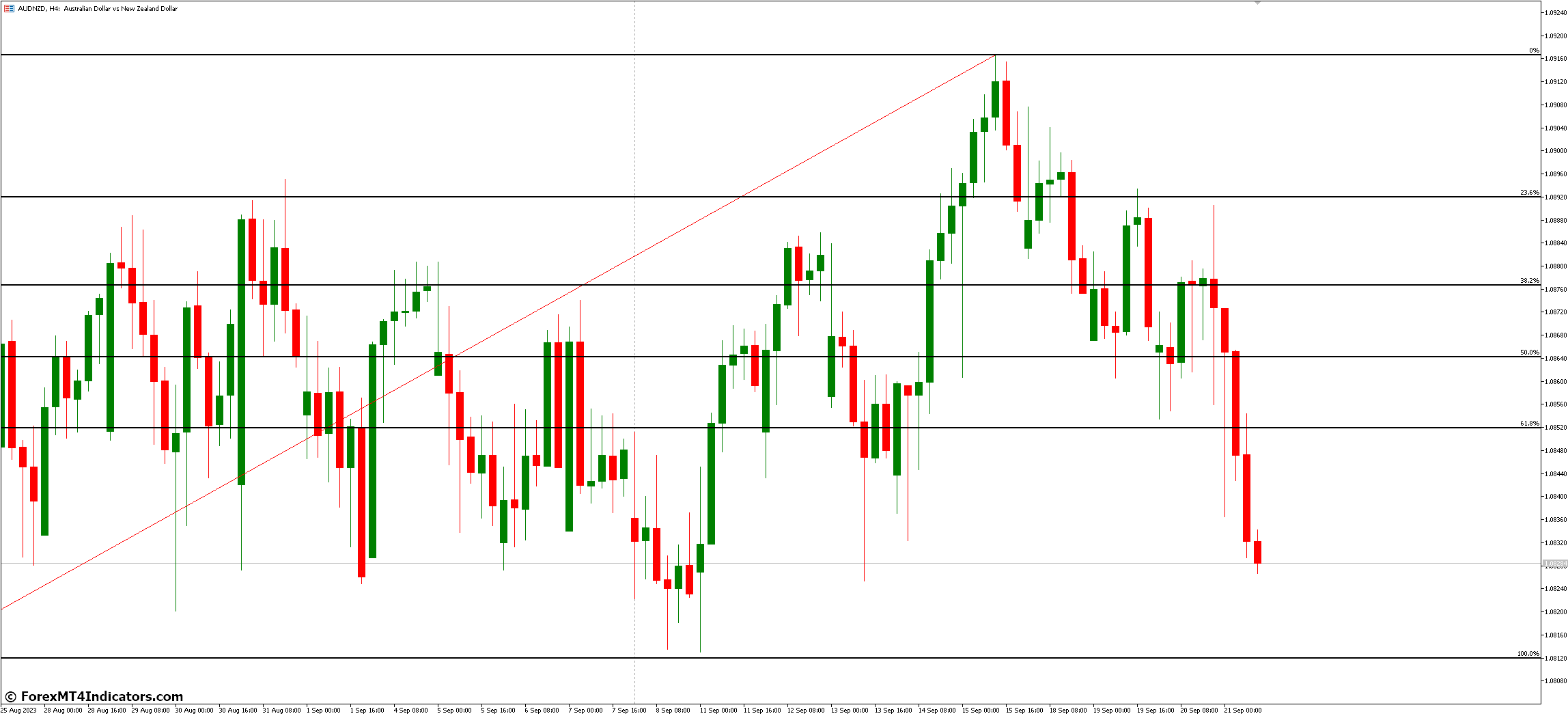

Fibonacci Retracement Tools

Fibonacci retracement tools are key for finding support and resistance levels. They use the Fibonacci sequence to guess where prices might pause or change direction.

| Indicator | Strength | Weakness | Best Use |

|---|---|---|---|

| DeMark Indicators | Precise reversal points | Complex for beginners | Trend exhaustion |

| Moving Averages | Easy to understand | Lag in fast markets | Trend direction |

| Fibonacci Retracement | Works in all timeframes | Subjective interpretation | Support and resistance levels |

Using these indicators together helps traders develop a strong cycle analysis strategy. This strategy aids in making smart decisions based on market cycles and price movements.

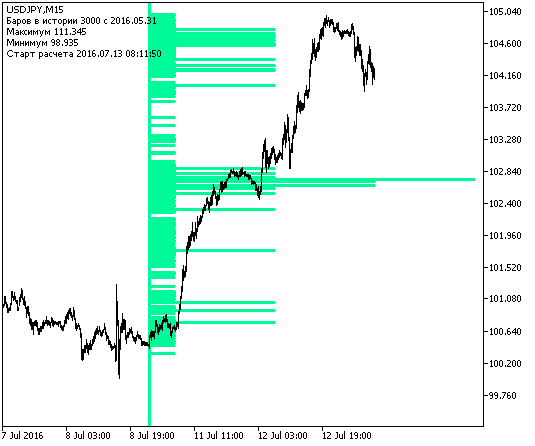

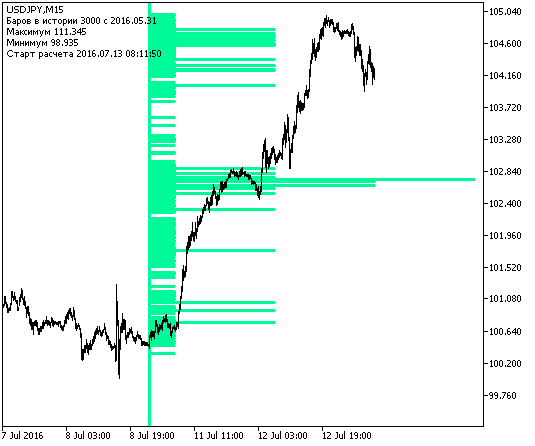

How to Identify Market Cycle Positions

Knowing how to spot market cycles is key for forex success. Traders use technical analysis and pattern recognition to find cycle phases. This helps them make smart trading choices.

Price action analysis is important for finding patterns. By looking at candlestick formations and chart patterns, traders can see when the market might change. These changes often mark the start of a new cycle phase.

Momentum indicators are great for checking cycle trends and changes. The Relative Strength Index (RSI) is very helpful. It shows when the market is overbought or oversold. This helps traders know if the market is in a certain phase.

Looking at trading volume also helps understand market cycles. High volume when prices go up means buyers are strong, like in markup phases. But high volume when prices drop shows sellers are strong, like in markdown phases.

| Cycle Phase | Price Action | Volume | RSI |

|---|---|---|---|

| Accumulation | Sideways movement | Low | Below 30 |

| Markup | Higher highs and lows | Increasing | 30-70 |

| Distribution | Price stagnation | High | Above 70 |

| Markdown | Lower highs and lows | Decreasing | 30-70 |

By using these methods, traders can find market cycle positions. This helps them make smart trading choices in the forex market.

Timing Strategies in Forex Market Cycles Analysis

Forex timing strategies are key in cycle-based trading. They help traders find the best times to buy and sell. This way, they can make more money and take less risk.

Entry Point Identification

Smart traders know when to buy. They look for the accumulation phase. This is when prices start going up after falling.

For selling, they watch the distribution phase. This is when prices are falling and the market is bearish.

Exit Strategy Development

Good exit strategies are important. Traders close long positions when the markup phase turns to distribution. They close short positions when the markdown phase goes back to accumulation.

This makes their trades more accurate and profitable.

Risk Management During Cycle Transitions

Managing risks is critical during cycle changes. The forex market is open 24/5. The U.S./London overlap is the busiest time, with 58% of all trades happening then.

This time is full of liquidity but also risk. Keeping an eye on economic indicators helps traders manage these risks better.

| Cycle Phase | Action | Risk Level |

|---|---|---|

| Accumulation | Enter long positions | Low to moderate |

| Distribution | Enter short positions | Moderate to high |

| Markup to Distribution | Exit long positions | Increasing |

| Markdown to Accumulation | Exit short positions | Decreasing |

Integration of Fundamental Analysis with Cycle Trading

Forex traders often use fundamental analysis in forex to understand the market better. They mix different analysis methods to grasp market cycles and make better choices. This method combines economic signs with technical patterns for a full trading plan.

Things like interest rates, GDP growth, and political events affect currency values. These are key in checking if cycle phases are right. For example, strong economic data in a country might show a bullish trend in the forex market.

Traders who get good at mixing analysis methods have an advantage. They can find chances that others might miss. This way, they can handle the market’s complexity with more confidence.

| Fundamental Factor | Potential Impact on Cycle |

|---|---|

| Interest Rate Hike | May trigger the accumulation phase |

| Weak GDP Report | Could signal the start of the markdown phase |

| Positive Trade Balance | Might support the ongoing markup phase |

| Political Instability | Can initiate or prolong the distribution phase |

By mixing fundamental analysis with cycle trading, forex traders can build a stronger strategy. This method helps spot important market changes and manage risks well in all market situations.

Common Pitfalls and Challenges in Cycle Analysis

Forex analysis can be tough, even for experts. Knowing market cycles is key, but it comes with its own set of problems. Let’s look at some common issues and how to get past them.

Avoiding False Signals

False signals are a big problem in forex trading. They come from market noise or sudden events. For instance, the VIX hit over 82 in March 2020, its highest in years.

This high volatility can confuse traders about market cycles. To avoid this, use many indicators and check signals in different timeframes.

Managing Overlapping Cycles

Markets don’t always follow a simple pattern. Cycles can overlap, making it hard to analyze. The S&P 500 grew 300% from 2009 to early 2020 but had many mini-cycles.

Traders must spot these smaller cycles within bigger trends. This helps make better choices.

Dealing with Market Noise

Market noise can hide real cycle movements. The 32.9% GDP drop in Q2 2020 made things even more confusing. To see through the noise, look at long-term trends and use moving averages.

Also, remember, that an RSI above 70 means overbuying, and below 30 means overselling. These signs can help spot real cycle changes amidst all the market talk.

By understanding these challenges, traders can better handle the complex world of forex market cycles. This improves their analysis skills.

Advanced Cycle Trading Techniques

Forex traders can improve their strategies with advanced techniques. These include using multi-timeframe analysis. This helps understand market cycles better and makes trading decisions more informed.

Multiple Timeframe Analysis

Looking at currency pairs on different time frames is key. This method gives a full view of market trends. For example, EUR/USD acts differently than GBP/USD, GBP/JPY, and USD/JPY.

By checking these pairs on various time frames, traders can find unique patterns. This helps them see the market’s cycles more clearly.

Cycle Synchronization Methods

It’s important to sync cycles across time frames for accurate predictions. Fibonacci time zones are great tools for this. Traders often wait for the third and fourth cycles before making big moves.

This method helps ensure the trend is strong and ongoing. It’s a way to confirm the direction of the market.

Momentum-Based Cycle Trading

Momentum indicators are essential in cycle trading. The RSI Heatmap, for example, shows medium-term cycles. Red areas show lows and green areas show highs.

This visual tool makes it easier to analyze cycles. It helps traders find the best times to enter and exit the market.

| Technique | Application | Benefit |

|---|---|---|

| Multi-timeframe Analysis | Examining currency pairs across timeframes | Comprehensive market view |

| Cycle Synchronization | Using Fibonacci time zones | Improved trend prediction |

| Momentum-Based Trading | Utilizing RSI Heatmap | Enhanced cycle identification |

Using these advanced techniques, traders can build stronger strategies. This can lead to more success in the fast-paced forex market.

Conclusion

Forex market cycle analysis is a key tool for traders. It helps them understand the complex world of currency trading. Knowing these cycles leads to better decisions and risk management.

By recognizing the four main phases, traders can match their strategies with market trends. This includes the accumulation, markup, distribution, and markdown phases.

Using cycle analysis goes beyond just spotting trends. It helps traders time their trades better. For example, taking long positions in the accumulation phase can be profitable.

Forex cycles are short, lasting weeks or months. But, they offer valuable insights when combined with other analysis methods. By using cycle analysis with technical indicators and risk management, traders can trade more effectively.

This approach helps traders deal with market changes more confidently. It makes their trading strategy stronger and more precise.

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0