POUND STERLING ANALYSIS & TALKING POINTS

- Elevated inflation combined with higher average earnings making things tough for BoE.

- 25bps hike in September an almost certainty!

- Descending triangle keeps bears hungry.

Recommended by Warren Venketas

Get Your Free GBP Forecast

UK’s Chancellor Hunt post-announcement: “While price rises are slowing, we’re not at the finish line.”

GBP FUNDAMENTAL BACKDROP

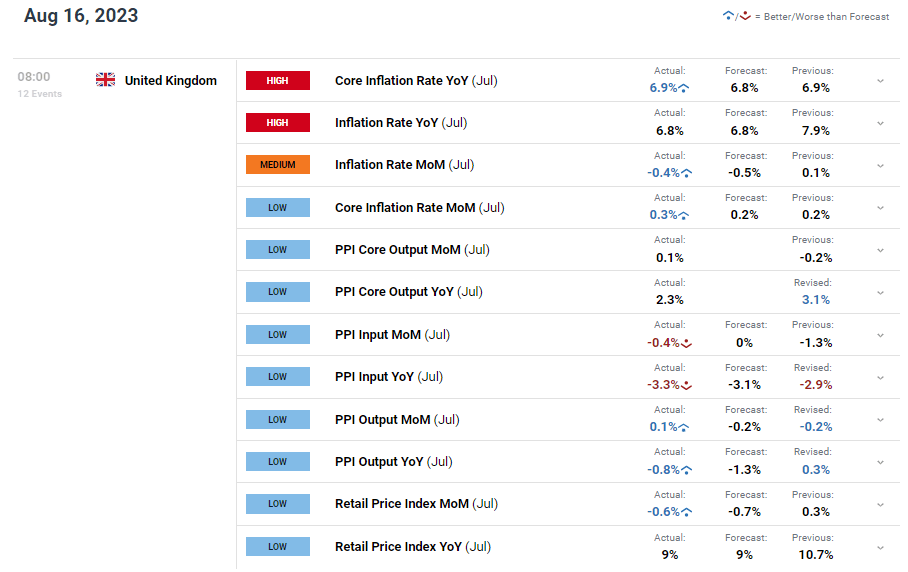

Before addressing the UK CPI report, lets cast our minds back to yesterday’s jobs data that revealed higher than expected average earnings figures despite moderating employment and unemployment readings. Services sector wage growth has been a major concern for the Bank of England (BoE) as a key contributor to core inflation.

Today’s CPI remained elevated on both core and headline inflation as well as various PPI metrics that could point to sustained inflationary pressures to come. According to the Office for National Statistics (ONS) report, the MoM CPI read fell by 0.4% relative to the 0.6% growth in the previous month with the highest upside contributor coming from Hotels and passenger transport by air.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

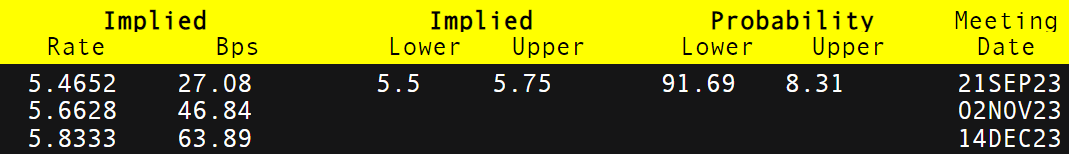

What does this mean for the BoE and their interest rate cycle? Looking at implied rates shown in the table below, little has changed pre and post-announcement. Markets are expecting with an almost 92% probability that the BoE will hike by 25bps in September. Taking into account the recent upside inflation report, the central bank may look to maintain this rate in November or hike further depending on incoming economic data between now and then. For now, the British pound may find some support after a recent bout of weakness against the greenback.

Later today, EUR/GBP and GBP/USD crosses will look to eurozone GDP and US building permit data respectively and should provide some short-term volatility.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

Enhance your macro fundamental understanding using the guide below:

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

TECHNICAL ANALYSIS

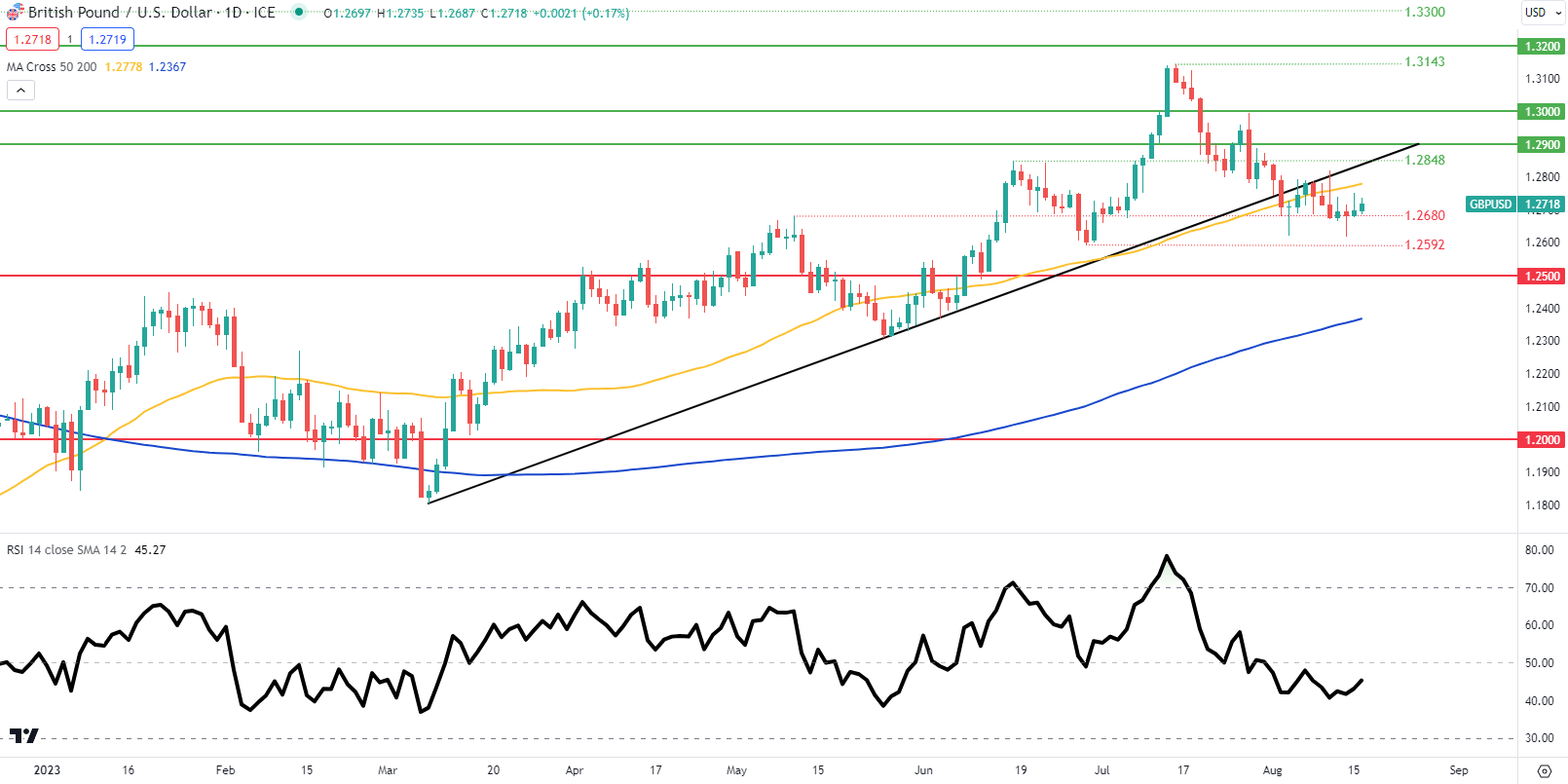

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart naturally pushed higher on additional interest rate hikes to come. The 1.2680 support handle has been tested several times of recent but has yet to be breached. That being said, the candlestick pattern being exposed seems to echo that of a descending triangle which traditionally points to subsequent downside (bearish continuation pattern). A confirmation close below 1.2680 could spark this move.

Key resistance levels:

- 1.2848

- 50-day moving average (yellow)

Key support levels:

CAUTIOUS IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 56% of traders holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0