Top High-Impact Forex News Events Traders Should Know

Are you finding it hard to keep up with the fast forex market? It’s easy to get lost in all the economic indicators. Missing out on high-impact forex news can hurt your trading. But we’re here to help. Imagine over 100 global economic events happening in just one week. The U.S. dollar is involved in

Are you finding it hard to keep up with the fast forex market? It’s easy to get lost in all the economic indicators. Missing out on high-impact forex news can hurt your trading. But we’re here to help.

Imagine over 100 global economic events happening in just one week. The U.S. dollar is involved in 90% of all forex trades. It’s a lot to handle, right? However, knowing key economic indicators like interest rates and inflation can help you navigate the market better.

Want to get better at forex trading? Let’s look at the economic indicators that matter most. We’ll cover central bank decisions and surprise data releases. This way, you can stay ahead and make smart trading choices.

Key Takeaways

- Major currency pairs like EUR/USD and GBP/USD offer high liquidity.

- Interest rate decisions and inflation reports are top forex market movers.

- U.S. economic data significantly influences global forex markets.

- Low unemployment rates often correlate with currency appreciation.

- Positive GDP growth typically leads to stronger currency values.

- Central bank interventions can directly impact forex demand.

- FOMC meetings provide key insights for forex traders.

Understanding the Importance of Economic News in Forex Trading

Economic news is key in forex market analysis. The forex market is open 24/5. U.S. economic news affects 88% of all currency trades. This shows why traders must know about important economic indicators and how they change currency values.

Big news events can cause big market swings. For example, a good retail sales report made the EUR/USD pair drop over 250 pips. This shows how vital it is to use economic news in trading plans.

Major economic announcements that move markets include:

- Interest rate decisions.

- Retail sales figures.

- Inflation rates.

- Unemployment data.

- Industrial production reports.

These announcements can affect different currency pairs in different ways. For instance, a 0.5% rise in inflation might lead to interest rate hikes. This can change how much a currency is worth. Also, strong GDP growth can make a currency go up, with a 2% quarterly increase possibly making it 1% more valuable in a month.

Market reactions to news can last from one to four days. This means traders need to keep analyzing and adjusting their strategies after economic news.

Knowing how economic news affects forex markets helps traders make better plans. This knowledge helps with preparation, managing risks, and finding chances to make money in the fast-paced world of forex trading.

High-Impact Forex News Events and Market Volatility

Forex traders must watch for big news events that cause market swings. These events can lead to fast price changes. This creates both risks and chances for traders. It’s key to know how news affects markets to make good trading plans.

Central Bank Policy Changes

Central bank decisions greatly affect forex markets. Changes in interest rates or quantitative easing can make currency values jump. For example, central bank interest rate decisions can cause big price changes in minutes.

Government Policy Shifts

Changes in government policies, like trade deals or tax changes, can last a long time. They can shape forex market trends for weeks or months. This affects trading plans for a while.

Unexpected Economic Data Results

Surprises in economic data can cause quick market reactions. For example, Non-Farm Payroll (NFP) reports often lead to big price swings. Unexpected GDP figures can also change currency values a lot.

| News Event | Typical Impact | Volatility Range |

|---|---|---|

| Interest Rate Decisions | High | 100-200 pips |

| NFP Reports | High | 50-100 pips |

| GDP Releases | Medium-High | 30-80 pips |

| CPI Data | Medium | 20-50 pips |

Traders use tools like the Average True Range (ATR) to predict price moves during news. They often multiply the ATR by 1.5-2 to set orders. This helps them deal with the extra market swings.

Major Interest Rate Decisions and Monetary Policy

Central banks’ interest rate decisions are key in shaping forex markets. These choices affect currency values and drive trends. The Federal Reserve, European Central Bank, and Bank of Japan are major players in global currency markets.

Central banks use interest rates to manage inflation and growth. When rates go up, a currency often gets stronger. This is because higher rates attract more foreign investment, boosting demand for the currency.

Lower rates can make a currency weaker. This happens when funds leave the country.

Interest rate differences between countries are important for traders. Many use carry trading, borrowing in low-interest currencies to invest in high-interest ones. This strategy can be profitable but also risky.

| Economic Condition | Interest Rate Trend | Currency Impact |

|---|---|---|

| Economic Expansion | Higher Rates | Currency Appreciation |

| Economic Downturn | Lower Rates | Currency Depreciation |

Monetary policy effects go beyond interest rates. Central bank announcements about quantitative easing or forward guidance can cause big market reactions. Traders watch inflation indicators and central bank statements to guess future policy changes and currency movements.

Employment Data and Labor Market Indicators

Employment reports and labor market data are key in forex trading. They give insights into the economy’s health. This affects currency values and trading choices.

Non-farm payrolls (NFP)

The NFP report comes out monthly from the U.S. Department of Labor. It tracks the number of paid U.S. workers, except for farm workers and some others. The NFP can greatly affect forex markets, causing big changes in currency pairs with the U.S. dollar.

Unemployment Rate Impact

The unemployment rate shows the jobless percentage in the labor force. A low rate means a strong economy, which can make a currency stronger. But, a high rate might make a currency weaker.

Wage Growth Statistics

Average hourly earnings data in employment reports show wage growth. Higher wages mean more spending power and could lead to inflation. Both are important for currency values.

| Indicator | Description | Frequency | Potential Forex Impact |

|---|---|---|---|

| Non-Farm Payrolls | Total paid U.S. workers | Monthly | High volatility in USD pairs |

| Unemployment Rate | Percentage of jobless in the labor force | Monthly | Currency strength/weakness |

| Average Hourly Earnings | Wage growth indicator | Monthly | Inflationary pressures |

Forex traders watch these data closely. They can cause big market shifts. Knowing how to read these reports is key for smart trading in the fast-paced forex market.

Inflation Metrics and Their Market Impact

Inflation data is key in forex trading. Traders watch various metrics to understand the economy and predict currency moves. Let’s look at important inflation indicators and their role in the forex market.

Consumer Price Index (CPI)

The CPI shows how prices of goods and services change. It greatly affects the forex market. When CPI goes up, a currency might get stronger because interest rates could rise. But if CPI falls, a currency might get weaker.

Personal Consumption Expenditures (PCE)

The PCE index is the Federal Reserve’s top choice for inflation tracking. It looks at price changes in what consumers buy. Forex traders watch PCE closely because it affects fundamental analysis in forex trading. A higher PCE can make the USD stronger against other currencies.

Producer Price Index (PPI)

PPI shows price changes from the seller’s side. It’s seen as a sign of what’s coming for consumer prices. Forex traders use PPI to guess future CPI trends and currency shifts.

| Inflation Metric | Description | Forex Impact |

|---|---|---|

| CPI | Measures consumer price changes | High CPI often strengthens the currency |

| PCE | Fed’s preferred inflation measure | Influences USD pairs significantly |

| PPI | Measures producer price changes | Indicates future consumer inflation trends |

Knowing these inflation metrics helps traders make smart choices. By looking at CPI, PCE, and PPI, traders can guess currency moves better. This lets them adjust their strategies.

Gross Domestic Product (GDP) Releases

GDP releases are key for traders. They show how fast an economy is growing. The U.S. Bureau of Economic Analysis shares GDP data monthly. It comes in three forms: advance, second, and final estimates.

These reports tell us the total value of goods and services made in the country. The impact on forex markets is big. For example, a 1.8% GDP in March 2011 was less than expected. This made the EUR/USD pair drop from 1.4200 to under 1.4050.

Trading in forex requires knowing different parts of GDP. Net exports, consumer spending, and business investments all add up. If GDP is higher than expected, the U.S. dollar gets stronger. But if it’s lower, the dollar might get weaker against other currencies.

| GDP Release | Date | Actual | Forecast | Previous |

|---|---|---|---|---|

| Q4 2025 (Projected) | TBA | 3.1% | N/A | N/A |

| Q3 2024 (Final) | Nov 27, 2024 | 3.1% | 2.8% | 3.0% |

| Q3 2024 (Advance) | Oct 30, 2024 | 2.8% | 3.0% | 3.0% |

| Q2 2024 (Final) | Aug 29, 2024 | 3.0% | 2.8% | 1.4% |

Traders need to watch GDP with other economic signs. This includes inflation and job numbers. These signs can make markets move in many ways. So, traders must analyze everything carefully.

Retail Sales and Consumer Sentiment Data

Retail sales and consumer sentiment data are key in forex trading. They give insights into the economy and currency movements.

Monthly Retail Sales Reports

Retail sales reports show how much people spend. They come out every month. Strong sales mean a currency might go up, while weak sales might make it go down.

The rise of online shopping makes these reports harder to understand.

Consumer Confidence Surveys

Surveys check how people feel about the economy. The University of Michigan and the Conference Board do these surveys. When people feel good, they spend more, which can make a currency stronger.

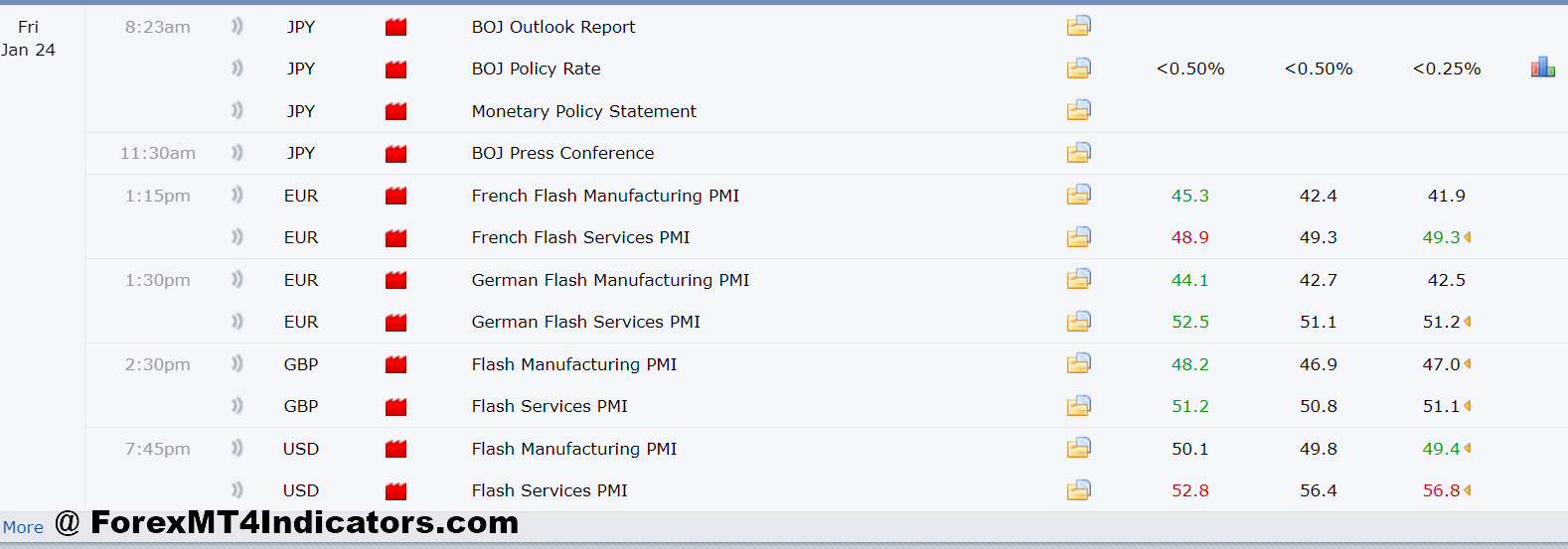

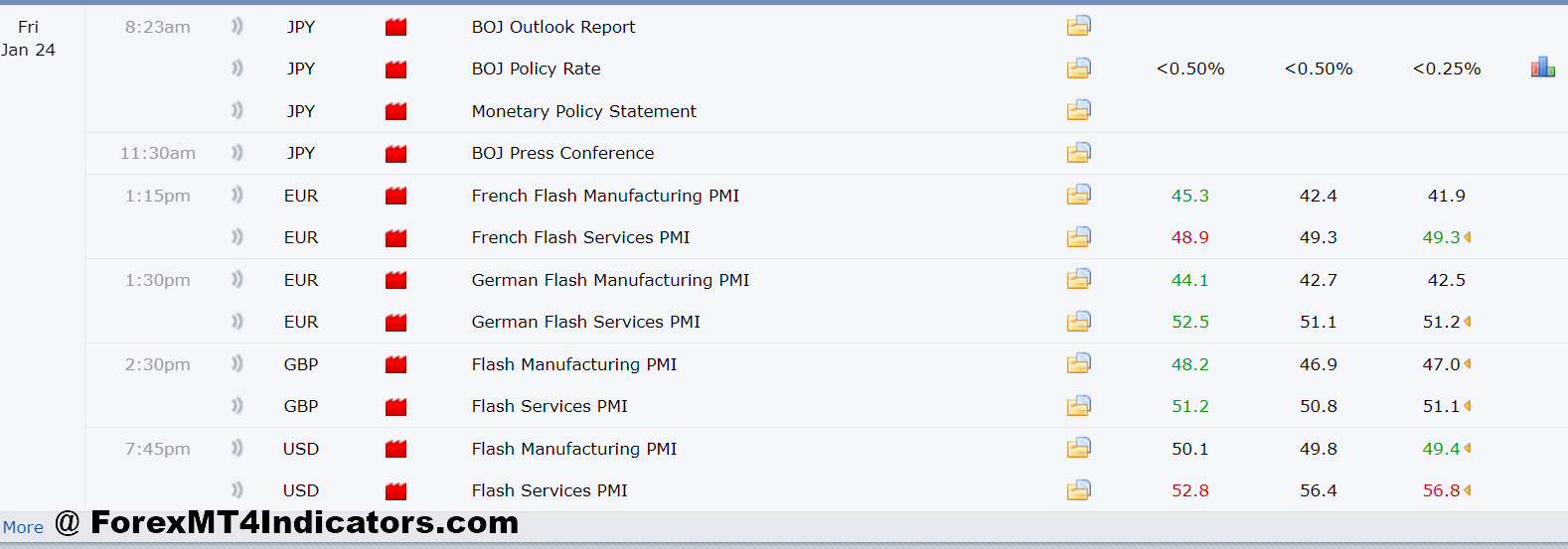

Business Sentiment Indicators

Business sentiment indicators, like the PMI, show what companies think. They can predict the economy’s future. When companies are optimistic, a currency might get stronger.

| Indicator | Release Frequency | Impact on Currency |

|---|---|---|

| Retail Sales | Monthly | Strong sales strengthen the currency |

| Consumer Confidence | Monthly | High confidence boosts currency |

| PMI | Monthly | Above 50 supports currency |

Traders use data on spending, sales, and feelings to make smart choices. These tools help them understand the economy. This way, they can guess how currencies might change in the forex market.

OPEC Meetings and Oil Price Impact

OPEC meetings are key in setting global oil prices and forex markets. They control about 40% of the world’s oil. Their decisions affect currency values and energy markets everywhere.

Crude Oil Production Decisions

OPEC’s choices can change oil prices a lot. For example, in March 2020, they couldn’t agree on cuts. This led to a big price drop.

Brent crude fell below $20 per barrel in April 2020. This was the lowest in two decades. Such big changes show how much oil prices affect forex globally.

Energy Market Effects on Currencies

Changes in oil prices affect currency values. The Canadian dollar, Norwegian krone, and Russian ruble are very sensitive. When oil prices go up, these currencies get stronger against the US dollar.

Trade Balance Implications

OPEC decisions change trade balances worldwide. Oil-exporting countries gain when prices rise. But, oil-importing countries pay more, which can weaken their currencies.

Forex traders watch OPEC closely. They use this info to plan their moves and adjust their strategies.

| Currency Pair | Oil Price Increase Impact | Oil Price Decrease Impact |

|---|---|---|

| USD/CAD | CAD strengthens | CAD weakens |

| USD/NOK | NOK strengthens | NOK weakens |

| USD/RUB | RUB strengthens | RUB weakens |

Geopolitical Events and Market Reactions

Geopolitical risk is key in forex markets. Political events can change currency values quickly. The forex market, which trades trillions daily, reacts quickly to global news.

Elections, wars, and natural disasters can move currencies a lot. For example, unexpected election results can drop a currency’s value by 3-10%. Natural disasters can cause a 2-7% drop right away, and the effect can last up to 15% long-term.

When there’s uncertainty, traders look to safe-haven currencies. The Japanese Yen and Swiss francs usually go up. For example, Brexit caused the British pound to drop by 8% in just hours.

| Event Type | Potential Currency Impact |

|---|---|

| Elections | 3-10% devaluation |

| Natural Disasters | 2-7% immediate decline, up to 15% long-term |

| War | 5-15% shift, 20% increased volatility |

| Major Political Events (e.g., Brexit) | Up to 8% drop within hours |

Traders who watch geopolitical events can guess market moves better. They can be right up to 70% of the time for short-term changes. This shows how important it is to know global politics when trading forex.

Conclusion

Learning forex news trading strategies is key to doing well in the fast-changing currency market. The economic calendar is very important, with over 150,000 traders using it to make smart choices. Big currencies like the US dollar, Euro, and Japanese yen quickly change with news, bringing both chances and dangers.

Important economic signs like jobs reports, retail sales, and GDP numbers help figure out the market’s health. These numbers can cause big swings, mainly in big currency pairs like USD/JPY and EUR/USD. Traders need strong ways to analyze the market to handle these ups and downs well.

It’s important to know how central bank meetings, world events, and surprise news affect things. For example, Brexit’s impact on GBP shows how politics can change currency values. Traders should keep up with global news and economic signs to guess market changes and handle risks well.

In this market driven by news, knowing economic indicators and market mood is essential. By being ready for big events and using good risk management, traders can make the most of market moves while keeping their money safe. Remember, to be good at forex trading, you must always keep learning and adjusting to new market changes.

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : ۰