The Smart Universal Expert Adviser – Trading Strategies – 7 November 2023

[ad_1] There is a 90% chance that you will waste your money when buying an EA because 90% of the EAs simply don’t work! This is the harsh truth that everyone is denying. In this blog, I want to open up and open your eyes. Hopefully, you will avoid wasting your money and make the

[ad_1]

There is a 90% chance that you will waste your money when buying an EA because 90% of the EAs simply don’t work!

This is the harsh truth that everyone is denying. In this blog, I want to open up and open your eyes. Hopefully, you will avoid wasting your money and make the right investment!

Think of an EA as an automated car. It has a computer that controls and tells the other parts of the car what to do. Now, an Expert Advisor is the same thing; it has an indicator that tells it when to open buy and sell orders. If the computer of the auto-car is broken, it will most certainly crash and endanger all the passengers. The same goes for the indicator of the EA. If it’s not good enough, it will lead to blowing your entire account, resulting in you losing all your money.

Don’t be the next victim. Instead, think smart!

Why do most sellers have many expert advisers? Have you ever asked yourself this question? But when you check the inputs, they are identical. That’s because the only difference between those experts is the indicator. If you bought an EA and want to buy another one, you would have to pay lots of money again for the same inputs. It just does not make sense.

That’s when I asked myself, “What if there is an EA that can work with any indicator?” I always think outside of the box.

What if I can offer traders an all-in-one EA that I will keep updating, and they can use it their entire life? All they have to do is keep trying indicators until they find the best one for them. A very smart idea, right?

And that’s how The Smart Universal Expert Adviser came to life.

If you invest in this EA, the 90% chance of losing money will decrease dramatically. Now you are not stuck with one EA that you paid who knows how much for! Yes, trust me, there are EAs with crazy price tags ($10k). I mean, guys, wake up!

Get it here in this link: Smart Universal Expert Adviser MT4 & Smart Universal Expert Adviser MT5

What to expect from this blog post?

Section 1: Definition: What is the smart universal expert adviser.

Section 2: Features and Inputs: know all the features of the smart universal expert adviser in detail.

Section 3: Online Course: You can take the entire Free online course right on this blog.

Section 4: How to? Step by step guide on how to use this EA.

Section 5: Frequently Asked Questions: We will answer all your questions.

Section 6: Conclusion: Summary of the blog.

Section 1: Definition

The “Smart Universal Expert Adviser” is an expert adviser designed to help you in your trading experience by seamlessly integrating with any custom indicator that provides buy and sell buffers. With its unmatched adaptability, this expert allows you to harness the full potential of your custom indicators and execute trades with precision and control.

We have added the Trend Breakout Catcher as a built in indicator, the Trend Breakout Catcher is non-repainting non-back painting and non-lagging indicator, that now can serve as your master indicator within the smart universal expert adviser.

The Smart Universal Expert Adviser is a versatile trading tool designed to work with any custom indicator that provides buy and sell signals. It serves as an automated trading solution that can execute trades based on the signals generated by the custom indicator. The expert adviser is equipped with various features to manage and control the trading environment, including manual simulation like setting (SL) and (TP) levels, implementing trailing stops, and activating breakeven functions to protect profits. Or Expert adviser style like loss recovery, drawdown reduction and much more. All these techniques can be controlled within the settings panel.

Moreover, the Smart Universal Expert Adviser incorporates a range of filters to safeguard trading capital and optimize trading strategies. These filters include controlling the maximum spread and slippage, avoiding trading during news events, limiting the number of trades taken at one time, and managing daily trade frequency, max lot, trading time filter. Additionally, it includes a max drawdown filter that stops trading or even exit all trades when a predefined drawdown level is reached to prevent excessive losses.

By offering seamless integration with custom indicators and providing extensive risk management tools, the Universal Expert Adviser aims to enhance traders’ efficiency and performance while ensuring capital protection. Please note that while the expert adviser can be a valuable tool, trading always involves risk, and it is essential to use it responsibly and with proper risk management practices.

This is an Expert Advisor that is highly customizable, allowing users to define their trading strategy, risk management, and trade execution preferences while incorporating various technical indicators and trading conditions. This flexibility enables traders to adapt the EA to different market conditions and their specific trading goals, Instead of getting stuck with one expert adviser that has zero customizability.

Section 2: Main Features and EA Inputs

Let’s define each of the main features:

1. Integration with Custom Indicators: This feature allows the adviser to incorporate custom technical indicators or algorithms created by the user. Custom indicators can be used to provide specific trading signals or filter market conditions.

2. Risk Management Tools: Risk management tools help traders control and mitigate potential losses. This can include setting stop-loss orders, take-profit levels, and position sizing based on risk tolerance.

3. Trade Management Features: Trade management features include functions for opening, monitoring, and closing trades. These features often include tools for setting entry and exit points, trailing stops, and partial position closure.

4. Indicator-Based Trading: This means the adviser makes trading decisions based on technical indicators and signals. These indicators can include moving averages, RSI, MACD, and many others.

5. Automated Trading System: An automated trading system allows the adviser to execute trades automatically based on pre-defined rules and parameters, without the need for manual intervention.

6. Universal Expert Adviser: This term implies that the software is designed to work across various financial markets and instruments, such as stocks, forex, cryptocurrencies, and commodities.

7. Support for All Timeframes and Markets: The adviser should be capable of analyzing and trading on different timeframes (e.g., minute, hourly, daily) and across various markets (e.g., Forex, equities, futures).

8. Multi-Account Usage: This feature enables the adviser to manage multiple trading accounts simultaneously, which can be useful for traders with diverse portfolios.

9. Real-Time Analysis: Real-time analysis involves monitoring and processing market data as it becomes available, allowing the adviser to adapt to changing market conditions.

10. Multiple Risk Management Filters: These are additional risk controls and filters that can be applied to trading decisions. They help further refine risk management strategies.

11. Trading Time Filters: This feature lets traders specify particular times of day or days of the week when trading should be active or inactive, aligning with specific market conditions or preferences.

12. Loss Recovery: Loss recovery mechanisms attempt to recoup losses after a losing trade, often through strategies like Martingale or averaging down. These methods can be risky and should be used with caution.

13. Drawdown Recovery: Drawdown recovery aims to bring an account back to profitability after it has experienced a significant drawdown. This typically involves adjusting position sizes and trading strategies.

14. Diversified Entry and Exit Strategies: This feature allows the adviser to employ various trading strategies, including different entry and exit techniques, to adapt to different market conditions.

15. Back-testing and Optimization: Back-testing involves testing the adviser’s strategy using historical data to assess its performance. Optimization includes fine-tuning parameters for better results.

16. Position Sizing Strategies: Position sizing refers to the determination of how much capital to allocate to each trade, often based on risk and portfolio management strategies. Various methods can be employed, such as fixed fractional, Kelly criterion, or volatility-based sizing.

Now lets explain the EA Inputs:

- Buy only or Sell only or Buy & Sell both: This input allows you to specify whether the EA should execute only buy orders, only sell orders, or both.

- Enable hedging On/Off: Hedging allows you to have both buy and sell positions open simultaneously. You can enable or disable this feature with this input.

- Trade on new candle open or don’t wait for a new candle open: This input determines whether the EA should initiate trades when a new candlestick is formed or enter positions immediately, regardless of candlestick completion.

- Auto risk or fixed risk: Auto risk typically refers to position sizing based on account balance and risk percentage, while fixed risk allows you to set a constant lot size for each trade.

- Use SL On/Off: This input lets you enable or disable the use of a stop loss (SL) for trades to limit potential losses.

- Use TP On/Off: This input enables or disables the use of a take profit (TP) level for trades to secure profits.

- Close trades on opposite signals On/Off: This feature decides whether the EA should close open trades when it generates a signal in the opposite direction.

- Use Drawdown filter On/Off: This is an option to apply a filter based on the account’s drawdown, which might prevent the EA from opening new trades if the account is experiencing significant drawdown.

- Maximum Drawdown from 0-100%: If the drawdown filter is enabled, this parameter specifies the maximum allowed drawdown as a percentage of the account balance.

- Close all open trades when max drawdown On/Off: This input dictates whether the EA should close all open trades when the maximum drawdown is reached.

- Maximum trades at one time On/Off: You can set a maximum limit for concurrent open trades, and this input lets you enable or disable this restriction.

- Maximum trades in one day 24 hrs On/Off: Similar to the above, this input enables or disables a restriction on the number of trades allowed within a 24-hour period.

- Maximum spread On/Off: You can define a maximum spread level, and this input allows you to enable or disable the EA from trading when the spread exceeds this limit.

- Maximum slippage On/Off: This parameter specifies the maximum slippage allowed for trade execution and can be turned on or off.

- Use loss recovery (by averaging) On/Off: Loss recovery mechanisms like averaging down can be enabled or disabled using this input.

- Lot multiplier: When loss recovery is used, this factor determines the increased lot size for each new trade in the recovery process.

- Risk mode Moderate/Aggressive: This input allows you to choose between moderate and aggressive risk modes, potentially affecting position sizing.

- Fixed distance: A fixed distance, often in pips, for setting stop loss or take profit levels.

- Dynamic distance On/Off: Dynamic distance adjusts stop loss and take profit levels based on market conditions. This input enables or disables that feature.

- Number of orders to start dynamic distance: This input specifies how many orders need to be open before dynamic distance is activated.

- Dynamic distance multiplier: It determines how much the stop loss and take profit levels should be adjusted based on market conditions.

- Global TP: A global take profit level that applies to all open trades.

- Use drawdown recovery On/Off: Enables or disables a drawdown recovery mechanism to help regain losses.

- Indent for drawdown recovery in points or percentage: This parameter determines the distance or percentage by which the EA will recover from drawdown.

- Maximum orders for loss recovery: Limits the number of additional orders opened for recovery when the loss recovery feature is active.

- Use required free margin for 0.01 lot On/Off: Enabling this input means the EA checks if there’s enough free margin to open a 0.01 lot size trade.

- Use max order lot On/Off: This input allows you to restrict the maximum lot size that can be traded.

- Use max total lot On/Off: You can impose a limit on the maximum total lot size for all open positions.

- Use breakeven On/Off: This input enables or disables a breakeven feature that moves the stop loss to the entry price when a trade reaches a certain profit level.

- Use ATR trailing stop On/Off: The ATR (Average True Range) trailing stop adjusts the stop loss based on market volatility. This input allows you to turn it on or off.

- Use point trailing stop On/Off: Similar to ATR trailing stop, this is a basic trailing stop based on a fixed number of pips.

- Use trading hours from HH:MM to HH:MM On/Off: This input lets you specify a time window for trading.

- Use Trade on (Monday, Tuesday, Wednesday, Thursday, Friday) On/Off: You can choose which days of the week trading is allowed.

- Use minutes between orders On/Off: Restrict the frequency of opening new orders by setting a minimum time gap between trades.

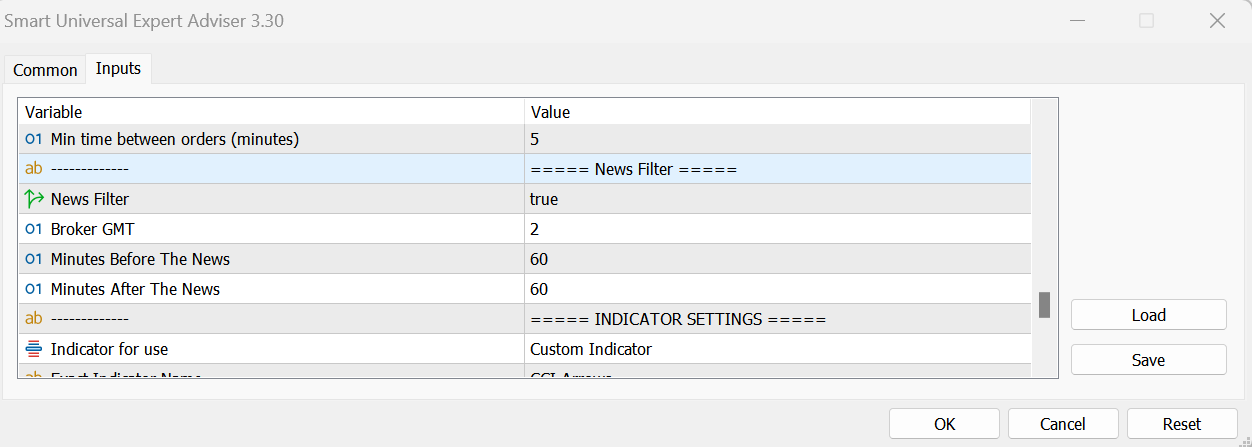

- Use news filter On/Off: Enable or disable a filter that avoids trading around major economic news releases.

- Use built-in indicator (Trend Breakout Catcher) On/Off: Determine whether the EA should use a built-in indicator for trading decisions.

- Use your custom indicator On/Off: This input enables or disables the use of a custom indicator of your choice for trading signals.

- Built-in indicator amplitude: If you are using the built-in indicator, this parameter may adjust its sensitivity or threshold.

- Built-in indicator smoothening: Smoothing settings for the built-in indicator.

- Trade on new arrow or trade on trend direction: Specify whether the EA should trade based on the appearance of a signal arrow or follow the trend direction as determined by the indicator.

- ATR period and coefficient: Parameters for the Average True Range (ATR) indicator, which is often used for determining stop loss and take profit levels based on market volatility.

These inputs provide traders with a wide range of options to customize their trading strategies and adapt them to their specific preferences and risk management requirements.

In summary, a “Smart Universal Expert Adviser” is a sophisticated trading software that integrates with custom indicators, offers extensive risk management and trade management tools, can work across multiple markets and timeframes, and provides various risk controls, trading strategies, and analytical features to help traders make informed and automated trading decisions. It should be adaptable to a wide range of trading preferences and styles.

Section 3: Free Online Course

We have Compiled the entire online course in one video for convenience, and now right in the below video you can take the entire online course: We will update this video as we create more video and/or strategies as we go.

Coming soon….

Section 4: How to?

Q: How to add your own Custom Indicator?

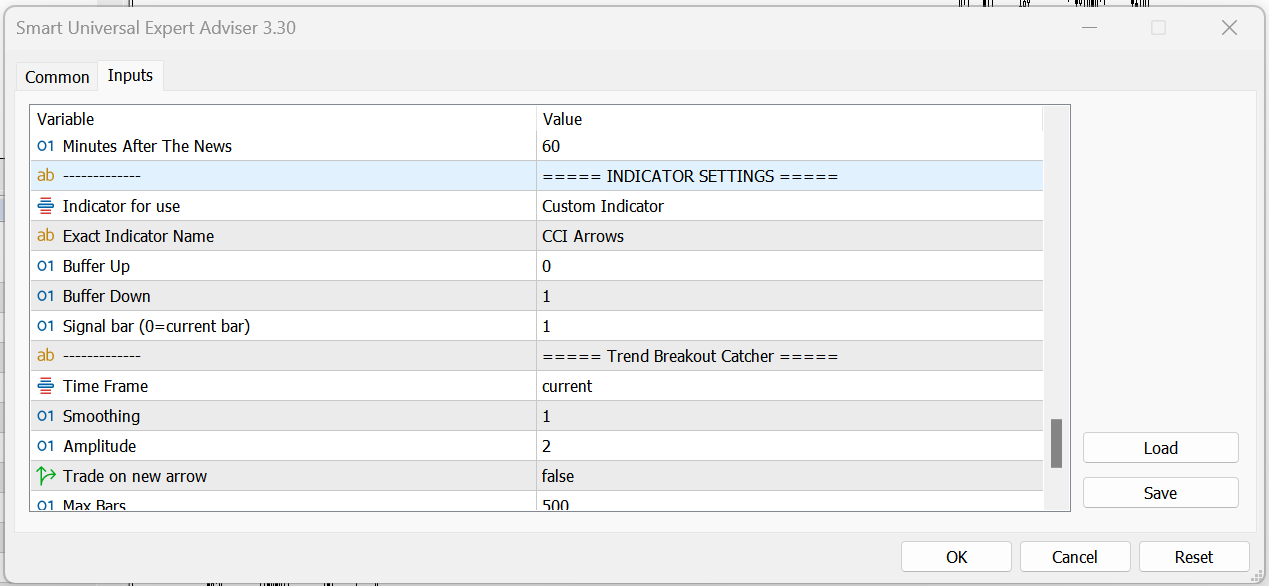

A: Refer to the picture below (figure 1) of the settings table of the SUEA “Smart Universal Expert Adviser”.

- When you attach the Indicator to the chart, scroll down and locate the Indicator settings tab.

- Select the “Indicator for use” tab and select Custom indicator.

- Type The name of your Indicator as it is with spaces on the “Exact indicator name” tab: Make sure the indicator is in your indicators folder exactly!

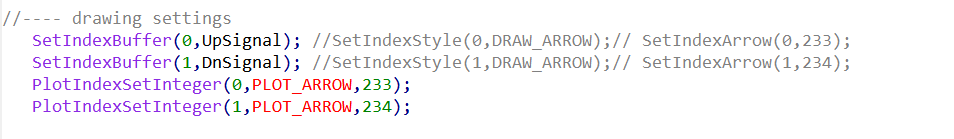

- Type the buy buffer and the Buffer Up and sell buffer and the buffer down: If you are not a developer ask the owner of the Indicator to give you the right buffers, they look like that in the bellow picture (figure 2).

- On the signal bar tab, you also should ask the owner of the indicator when the signal happens on the current or previous bar put 0 for the current otherwise put 1.

figure 1: SUEA Settings table

figure 2: Buffer inside of the code

Q: How to trade using stoploss and take profit on a manual simulation set up?

A: Now that we have enabled the custom indicator lets apply the manual simulation set up to that indicator refer to figure 3 below:

- In the below setting table locate “Use loss recovery settings” and set it to false: this will disable the loss recovery using martingale or averaging.

- Choose to use buy or sell only or both.

- Choose to enable hedging: if true it will open buy and sell trades at the same time on the same instrument.

- Choose the fixed lot or the auto lot recommended in this set up since it will calculate the % of your balance in relation the Stop loss.

- Now we can set up our stop loss in point, and the take profit in multiples of the stop loss! very easy and intuitive! you can choose to turn the SL and TP On/Off as you wish.

- Use the trading filters to set up the trading environment, for your strategy: Drawdown, spread, slippage trading frequency…

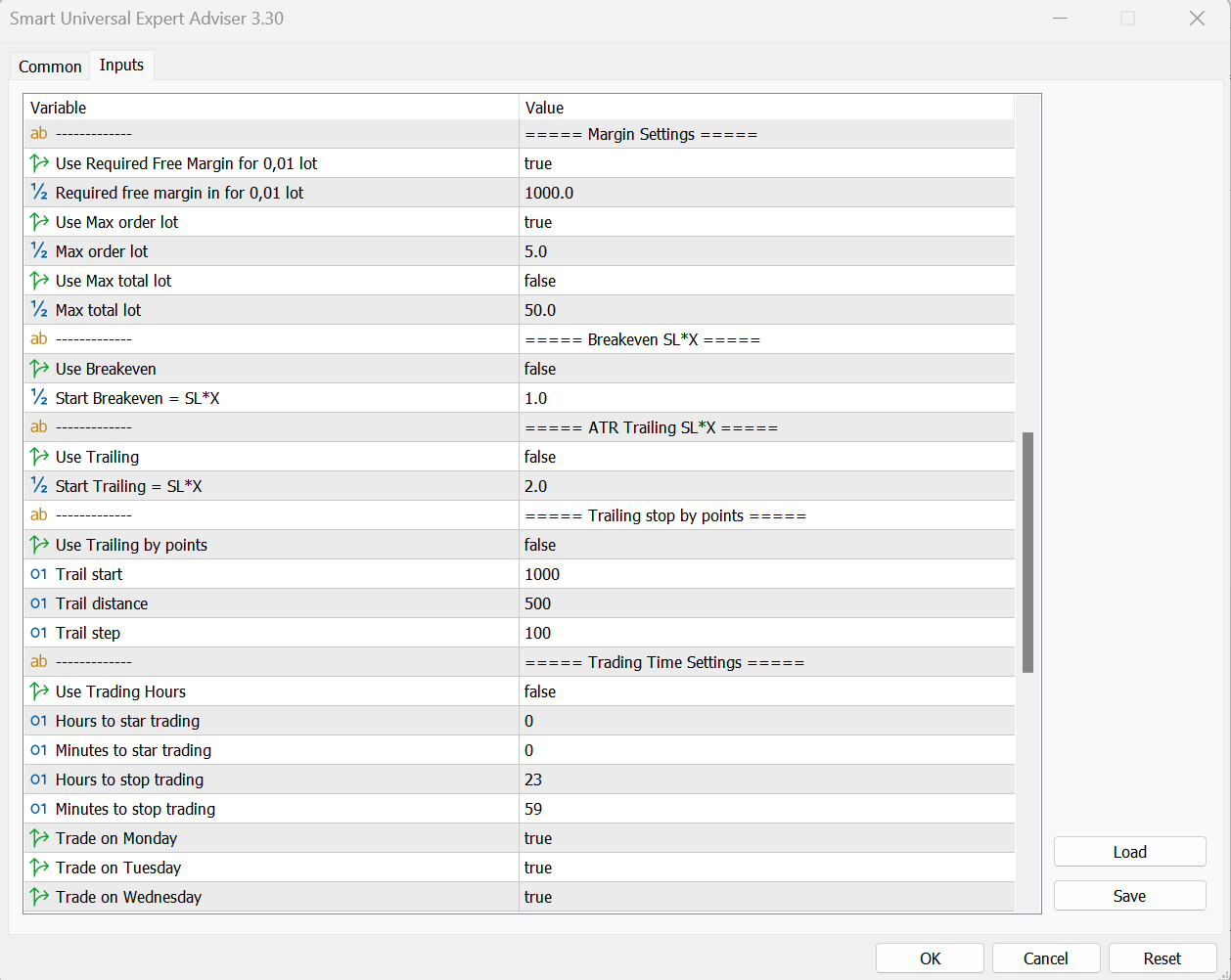

- scroll down the setting table to enable advanced settings such as Breakeven and Trailing stop. figure 4.

- Choose the trading time of the day by hours and choose the trades to trade. Figure 4.

- Control the margin settings like the max total lot or the max lot on one trade. figure 4.

- Finally click ok, and the EA will be attached to the chart and start taking trades whener the indicator detects a buy or sell.

figure 3: Manual simulation

figure 4: Manual simulation

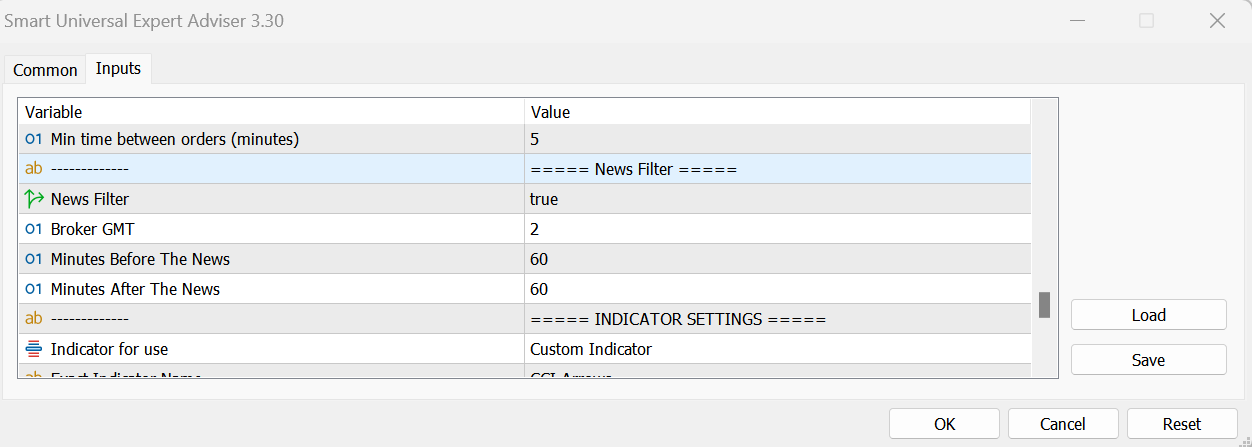

Q: How to Enable News filter to avoid bad news moves?

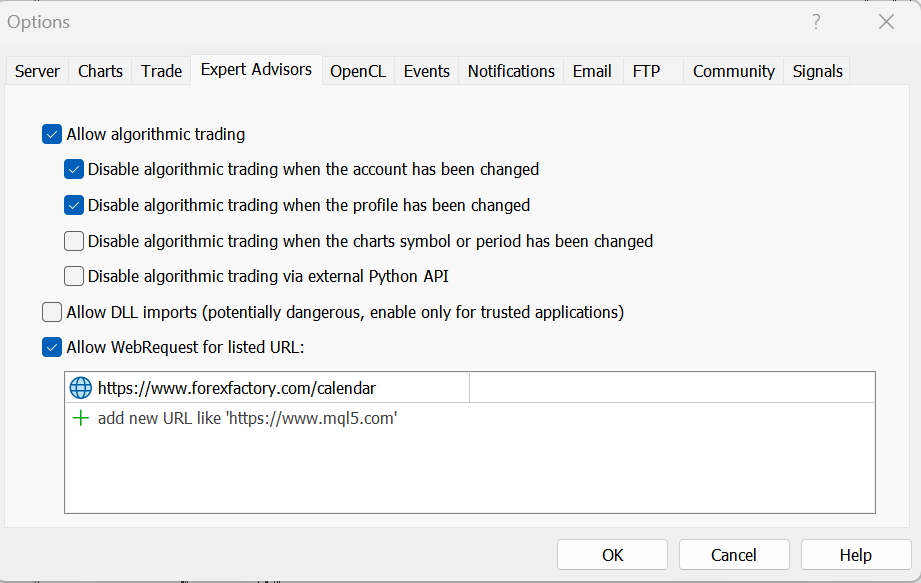

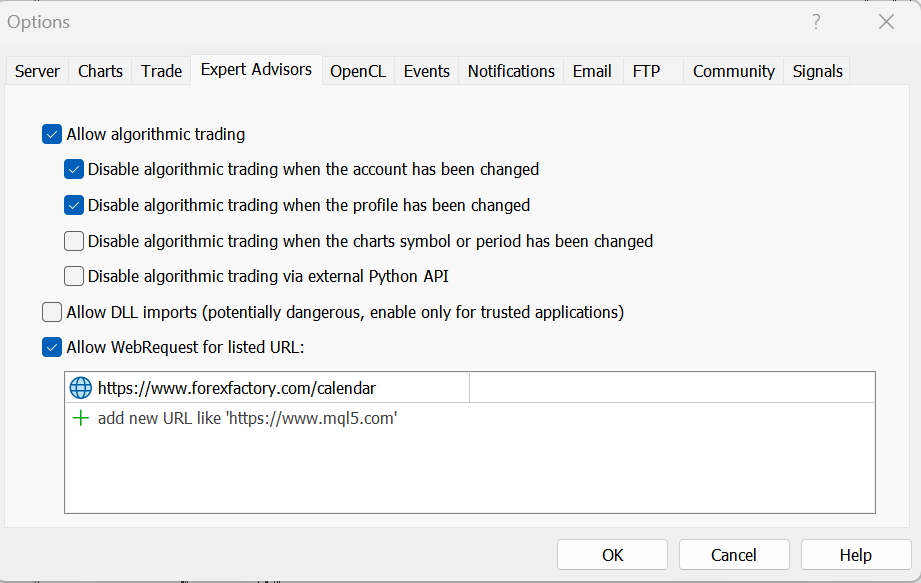

A: Refer to the figure 5 below:

- Locate the news filter tab on the settings table.

- Set the news filter to True.

- Now go to the meta trader and click Tools>>Options>>Expert Adviser You will see figure 6 below

- check the box that says Allow WebRequest For Listed URL:

- Add the URL of the calendar as it is in the picture.

- Check out your broker time and adjust the broker GMT by adding the right value.

- Set up the time in minutes before and after the new: this is the time that will be respected and no trades will be opened during this period.

figure 5: News Filter

figure 6: Web Request

figure 5: News Filter

figure 6: Web Request

Q: How to Use the Loss Recovery “Martingale”?

A: Refer to figure 7 below the loss recovery strategy:

- Locate the loss recovery in the setting table and turn “use loss recovery” ON: Now on this mode every time the indicator offers a buy or sell signal the EA will open a trade without SL and set a Global TP of 150 points (this global TP you can control it and set your own TP), Every time the TP is hit the trade will be closed and the EA will wait for the next signal.

- In case the trade is going against us the EA will open trade as the market goes further against as using the averaging technique and a global TP until the Tp is Hit.

- In case the Loss recovery took very long time we might get into a big Drawdown. Thats why we have a drawdown DD recovery, This technique will close trades on occasion to keep the DD under control (Below are the settings of each input)

- With the same set up we can control the max number of orders the averaging will open during loss recovery and we can control the max lot that can be opened during the loss recovery as well.

-

Section 5: Your Questions Answered

In this section, we’ll address common questions that traders may have about the Smart Price Action Concepts. We’ll provide detailed answers to ensure readers have a clear understanding of the system and how it can benefit their trading.

1- FAQs

Q: How to Use the “Universal Expert Adviser”?

A: Follow below steps:

- Integration with Custom Indicators: Effortlessly link the “Smart Universal Expert Adviser” to your preferred custom indicator that generates buy and sell signals.

- Buy and Sell Trade Management: Once connected, the expert automatically executes buy and sell trades based on the signals generated by the custom indicator.

- Risk Management: Take charge of your trades by setting (SL) and (TP) levels, ensuring you protect your capital.

- Trailing Stop and Breakeven Function: Optimize your trades with the trailing stop feature, locking in profits as the market moves in your favor. Additionally, activate the breakeven function to protect your trades from potential reversals.

- Filters for Capital Protection: The “Smart Universal Expert Adviser” offers an array of advanced filters to safeguard your trading capital and optimize your strategy. These filters include:

- Max Spread Filter: Avoid taking trades when the spread exceeds a predefined value, preventing unfavorable execution

- Max Slippage Filter: Ensure trades are executed within an acceptable slippage range, reducing unexpected deviations.

- News Filter: Steer clear of volatile market conditions during major news announcements to minimize risks.

- Trade Frequency Filter: Control the number of simultaneous trades to manage risk exposure effectively.

- Daily Trades Frequency: Set a limit on the number of trades that can be taken within a 24-hour period to maintain discipline and prevent overtrading.

- Max Drawdown Filter: Safeguard your capital by pausing trading activities when a predetermined drawdown level is reached.

Q: How to integrate my custom indicator with the smart universal expert adviser?

A: Integrating your custom indicator with the Universal Expert Adviser is a straightforward process. Follow these steps to successfully integrate your custom indicator:

- Compile your custom indicator: Make sure your custom indicator is error-free and compiled correctly in MetaEditor. The indicator should provide buy and sell signals through buffer values.

- Copy the custom indicator file: Copy the compiled custom indicator file (ex4 or ex5) to the “Indicators” folder in your MetaTrader terminal.

- Attach the custom indicator to the chart: Open the desired trading chart on which you want the Universal Expert Adviser to trade. Drag and drop your custom indicator from the Navigator window to the chart. A dialogue box may appear with input parameters for the indicator. Set the desired parameters and click “OK.”

- Attach the Universal Expert Adviser: Drag and drop the Smart Universal Expert Adviser (ex4 or ex5 file) to the same chart where you attached your custom indicator. The Expert Adviser properties window will pop up.

- Configure the Expert Adviser settings: In the Expert Adviser properties window, you can set various parameters related to trading, risk management, and filters. These settings will help you customize the behavior of the Smart Universal Expert Adviser according to your preferences and risk tolerance. And most importantly add the name of the custom indicator in the indicator name in this format (Indicators\\YourIndicatorName), Also add the Buy and Sell buffers of your Indicator, in the respective fields.

- Enable automated trading: In the top toolbar of MetaTrader, make sure the AutoTrading button is activated (green) to enable automated trading for the Expert Adviser.

- Allow DLL imports: If your custom indicator requires external DLL files, make sure to enable the “Allow DLL imports” option in the Smart Expert Adviser properties window.

- Test on a demo account: Before using the Smart Universal Expert Adviser on a live account, it is recommended to test it thoroughly on a demo account to ensure it performs as expected and meets your trading requirements.

Q: How to use it with this CCI Indicator Here?

A: Integrating the CCI Custom indicator with the universal expert advised:

- download the free cci indicator Here, Drag and drop it from the Navigator window to the chart. A dialogue box may appear with input parameters for the indicator. Set the desired parameters and click “OK.”

- Attach the Universal Expert Adviser: Drag and drop the Universal Expert Adviser to the same chart where you attached the CCI indicator. The Expert Adviser properties window will pop up.

- Configure the Expert Adviser settings: In the Expert Adviser properties window, you can set various parameters related to trading, risk management, and filters. These settings will help you customize the behavior of the Universal Expert Adviser according to your preferences and risk tolerance. And most importantly add the name of the custom indicator in the indicator name in this format (Market\\ CCI Arrows For expert Advisers MT5), Also add the Buy (0) and Sell (1) buffers of your Indicator, in the respective fields.

- Enable automated trading: In the top toolbar of MetaTrader, make sure the AutoTrading button is activated (green) to enable automated trading for the Expert Adviser.

- Allow DLL imports: If your custom indicator requires external DLL files, make sure to enable the “Allow DLL imports” option in the Expert Adviser properties window.

- Test on a demo account: Before using the Universal Expert Adviser on a live account, it is recommended to test it thoroughly on a demo account to ensure it performs as expected and meets your trading requirements.

The “Smart Universal Expert Adviser” will help execute your trading strategies with confidence, ensuring optimal capital preservation while capitalizing on market opportunities. Its compatibility with a wide range of custom indicators and robust filters allows for a personalized and tailored trading experience.

Q: How much does it cost:

A: Current Price $200 Minimum, But Possible Future Price $900!

Q: Do you Sell outside of the Mql5 community?

A: Absolutely not, Its is against the rules of mql5 community and anybody who sells using our brand name is a scam and should be avoid at any cost.

Q: Can I use it on all timeframes and all markets?

A: YES, It Can be used on All Markets and All Timeframes.

Q: Can I use this expert on multiple charts?

A: Yes, you can use it on multiple charts. Simply add it to each chart from the Navigator window.

Q: Can I use this expert on multiple trading accounts?

A: Yes, You can use it on multiple trading accounts.

Q: How do I install this expert I purchased?

A: To install the custom indicator you purchased, follow these steps:

- If you still didn’t buy the indicator by clicking the buy button above.

- Refresh the page and you will see Install button.

- Click install the web page will ask your to open MetaTrader, Click Confirm.

- Open MetaTrader and go to “Navigator” -> “Experts” -> “Market”, you will see your newly bought indicator listed.

- double click or click and drag to the chart.

- setting window will open, custom your preferred setting and confirm.

Q: Do you have the other version of MetaTrader?

A: Yes, you can find the other version Here.

Q: What’s The Smart Universal Expert Adviser ?

A: The Smart Universal Expert Adviser is a versatile trading tool designed to work with any custom indicator that provides buy and sell signals. It serves as an automated trading solution that can execute trades based on the signals generated by the custom indicator. The expert adviser is equipped with various features to manage and control the trading environment, including setting stop-loss (SL) and take-profit (TP) levels, implementing trailing stops, and activating breakeven functions to protect profits.

Moreover, the Smart Universal Expert Adviser incorporates a range of filters to safeguard trading capital and optimize trading strategies. These filters include controlling the maximum spread and slippage, avoiding trading during news events, limiting the number of trades taken at one time, and managing daily trade frequency. Additionally, it includes a max drawdown filter that stops trading when a predefined drawdown level is reached to prevent excessive losses.

Q: Can I get support or assistance with using the universal expert adviser?

A: Yes, if you have any questions or need assistance, you can contact us through the MQL5 website or the provided contact information.

2- Ask Your Question

Do you have a question about the Smart Trend Trading System? We’re here to help and make things easy for you. Feel free to ask any question, no matter how big or small it may seem. Whether you want to know more about the strategies, indicators, or how to use this system for your trading, we’ve got you covered.

Just leave your question in the comments below. Our experts are ready to provide you with the answers you need. Your questions are important to us, and they guide us in making your trading experience better. So go ahead, ask your questions, and let’s work together to reach your goals in the forex market!

Section 6: Conclusion:

In the complex world of trading, simplicity is the key to success. The Smart Price Action Concepts Indicator isn’t just a tool; it’s your ticket to a smarter, more confident trading journey.

With crystal-clear insights into price movements and a clutter-free chart, you’ll finally trade with the clarity and focus you’ve been yearning for. Say goodbye to confusion and chaos, and embrace the power of a single, sophisticated indicator that simplifies your trading life.

Imagine trading like the pros, understanding the secrets of smart money concepts, and confidently making moves that count. The opportunities you’ve been missing are now within reach. It’s time to join the ranks of successful traders who read the market like an open book.

Don’t let this chance slip through your fingers. The Smart Price Action Concepts Indicator is your golden ticket to a more prosperous trading future. Take control, trade with clarity, and unlock the potential you’ve always had.

Take Action Now:

Buy it here: Smart Universal Expert Adviser MT4 & Smart Universal Expert Adviser MT5

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0