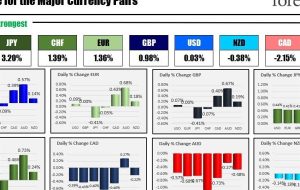

The JPY is the strongest and the AUD is the weakest as the North American session begins

[ad_1] The strongest to weakest of the major currencies The JPY is the strongest and the AUD is the weakest as the North American session begins. The USD is mixed and in the middle of the “strong to weak” rank above with gains vs the CAD, AUD, NZD, and declines vs the JPY, EUR, GBP

[ad_1]

The strongest to weakest of the major currencies

The JPY is the strongest and the AUD is the weakest as the North American session begins. The USD is mixed and in the middle of the “strong to weak” rank above with gains vs the CAD, AUD, NZD, and declines vs the JPY, EUR, GBP and CHF.

The Australian CPI overnight came in at 0.8% QoQ which was lower than the 1.0% expected. The YoY came in as expected that 5.4% versus 5.6% last month while the Trimmed Mean QoQ was lower-than-expected of 0.9% versus 1.1% expected. That help to weaken the AUD.

Today is the Fed rate decision (at 2 PM ET. The Fed chair will conduct a press conference starting at 2:30 PM ET). The Federal Reserve is expected to raise interest rates by a quarter-percentage point to 5.5%. That will take the rate to a 22-year high. The market sees the hike as the last in the cycle. The Fed is not so sure. The dot plot – released at the last Fed meeting in June – had the Fed members targeting two more hike before year-end (with one today).

The Fed has raised rates for ten consecutive increases, before the Fed pause in June. Fed Chair Jerome Powell has previously stated that if the economy evolves as expected, a slower, quarterly pace of rate increases may continue. Traders are interested to learn if an additional reading or two like the June consumer-price index would cause officials to revise their inflation forecast downwards. In June, the Fed raised their interest-rate projections in part because they expected inflation to make less progress. Finally, Fed officials might face questions about the outlook for the neutral interest rate – the rate that balances supply and demand when the economy is operating at full strength. Is it higher?

Meanwhile, the major indices are trading modestly lower ahead of the decision. The Dow is going for a tie of the record of 13 consecutive up days, but Microsoft is dragging the index lower. After the close yesterday, Alphabet and Microsoft reported earnings. Both beat but the stocks are moving in different directions in pre-market trading:

For Alphabet:

- Alphabet’s Q2 2023 earnings per share (EPS) was $1.44, surpassing the forecast of $1.34.

- Alphabet’s Q2 2023 revenue was $74.6 billion, exceeding the predicted $72.82 billion.

Alphabet’s strong financial performance led to its shares increasing by 6.17% in after-hours trading.

For Microsoft:

- Microsoft’s Q4 2023 EPS was $2.69, higher than the anticipated $2.55.

- Microsoft’s Q4 2023 total revenue was $56.2 billion, surpassing the predicted $55.47 billion.

- Revenue breakdown for Microsoft: Productivity and Business Processes – $18.29 billion, Intelligent Cloud – $23.99 billion, and More Personal Computing – $13.91 billion, all slightly higher than expected.

- Microsoft’s Q4 2023 operating income was $24.25 billion, exceeding the forecast of $23.28 billion.

- Microsoft’s Q4 2023 capital expenditure (CapEx) was $8.94 billion, higher than the predicted $7.85 billion, suggesting strategic investments in infrastructure and capabilities.

Microsoft’s CFO Amy Hood stated that monetization from AI services would be a “gradual” process. Microsoft is maintaining a conservative outlook on AI adoption, creating potential for significant increases in earnings as we move into fiscal 2024.

In earnings this morning they showed mostly BEATS.

-

Hess Corp (HES) Q2 2023:BEAT. Reported adjusted earnings per share (EPS) of $0.65, surpassing the expected $0.50. Revenue came in at $2.32 billion, beating the estimate of $2.09 billion.

-

Boeing Co (BA) Q2 2023: BEAT. Reported an adjusted EPS of -$0.82, better than the expected -$0.94. Revenue was $19.75 billion, higher than the anticipated $18.45 billion. The company also announced it is increasing the production rate of 737 MAX jets from 31 to 38 per month.

-

Fiserv Inc (FISV) Q2 2023: BEAT. Reported adjusted EPS of $1.81, slightly outperforming the expected $1.79. Revenue came in at $4.76 billion, beating the estimate of $4.54 billion.

-

General Dynamics Corp (GD) Q2 2023: BEAT. Reported an EPS of $2.70, beating the expected $2.56. Revenue came in at $10.2 billion, outperforming the anticipated $9.46 billion.

-

CME Group Inc (CME) Q2 2023: MISS. Reported an EPS of $2.14, which is lower than the expected $2.20. Revenue was $1.4 billion, higher than the anticipated $1.34 billion.

-

Automatic Data Processing Inc (ADP) Q2 2023: BEAT. Reported adjusted EPS of $1.89, surpassing the expected $1.83. Revenue came in at $4.48 billion, outperforming the anticipated $4.39 billion. The company projects adjusted EPS to grow 10%-12% in FY24, and revenue to grow 6%-7%.

-

Coca-Cola Co (KO) Q2 2023: BEAT. Reported an EPS of $0.78, surpassing the expected $0.72. Revenue was $12.0 billion, beating the estimate of $11.75 billion. The company also raised its FY guidance.

-

AT&T Inc (T) Q2 2023: MISS. Reported adjusted EPS of $0.63, narrowly beating the expected $0.60. Revenue came in at $29.917 billion, slightly below the anticipated $29.94 billion. However, the company expressed confidence in achieving its full-year guidance.

-

Hilton Worldwide Holdings Inc (HLT) Q2 2023: BEAT. Reported an EPS of $1.63, outperforming the expected $1.58. Revenue was $2.66 billion, surpassing the anticipated $2.58 billion. Hilton also raised its full-year EPS guidance to $5.91-$6.06.

-

After the close Meta, Chipotle, ServiceNow, Lam Reseach, Ebay, and Mattel will be released. Tomorrow will be another big day for earnings with the following releases:

-

McDonald’s

-

Southwest

-

MasterCard

-

Honeywell

-

Ford

-

Intel

-

Roku

-

First Solar

-

T-Mobile

-

US Steel

The weekly US mortgage application this morning showed:

- Mortgage Refinance Index was at 444.5 for the week, slightly down from the previous value of 446.4.

- MBA Purchase Index dropped to 159.2 from the previous week’s 163.2.

- Mortgage Market Index decreased to 206.9 from the previous 210.7.

- MBA Mortgage Applications decreased by 1.8% week-over-week, compared to a 1.1% increase in the previous week.

- MBA 30-Year Mortgage Rate remained stable at 6.87%.

At 10:00am, the New Home Sales report is expected to be released with a prediction of 763K. At 10:30am, the Crude Oil Inventories report is due with an estimated decrease of 0.7 million barrels. Late yesterday, the private API data showed:

- Crude oil inventories increased by 1.1319 million barrels. Est today is drawdown of -2.348M

- Gasoline inventories decreased by 1.043 million barrels. The estimate today is for a drawdown of -1.678M

- Distillate inventories increased by 1.614 million barrels. The estimate today is for a draw of -0.301M

A snapshot of the markets as the NA session gets underway shows:

- Crude oil is trading down one dollar or -1.24% at $78.64. It’s a 200 day moving averages back down at $77.10

- Spot gold is trading up $7 or 0.36% at $1971.80

- Silver is trading down $0.06 or -0.24% at $24.62

- Bitcoin is trading at $29,183 slightly lower than the 5 PM level at near $29,210

In the premarket for US stocks, the major indices are trading lower. The Dow Industrial Average is down marginally after closing higher for the 12th consecutive day yesterday. A gain today would match the longest string for consecutive updates at 13

- Dow Industrial Average is trading down -48 points, after rising 26.83 points yesterday

- S&P index is trading down -7.75 points after rising 12.80 points yesterday

- NASDAQ index is trading down -55 points after yesterday’s 85.69 point rise

In the European equity markets, the major indices are mostly lower.

- German DAX, down -0.99%

- France’s CAC, -1.94%

- UK’s FTSE 100, -0.60%

- Spain’s Ibex, is bucking the trend with a gain of 0.17%

- Italy’s FTSE MIB, -0.20% (delayed).

In the Asian Pacific market today, markets closed mixed:

-

Japan’s Nikkei 225, -0.04%

-

China’s Shanghai Composite, -0.26%

-

Hong Kong’s Hang Seng, -0.36%

-

Australia’s S&P/ASX 200, +0.85%

In the US debt market, yields are lower in early US trading

- 2-year yield, 4.876% -1.6 basis points

- 5-year yield 4.145% -2.9 basis points

- 10-year yield 3.84% -2.7 basis points

- 30-year yield 3.936% -1.7 basis points

In the European debt market, benchmark 10-year yields are higher:

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0