[ad_1] US yields continue their move lower: 2-year yield 4.924% -14.6 basis points 5-year yield 4.620%, -19.8 basis points 10-year yield 4.706% -16.8 basis points 30-year yield 4.906% -11.8 basis points At the start of the Asian-Pacific session, US yield curve look like the following: 2-year yield 4.954% -12.1 basis points 5-year yield 4.662% -15.6

[ad_1] © Reuters. The Bank of Japan (BOJ) has made a dovish adjustment to its Yield Curve Control (YCC) policy, leading to a weakened Japanese yen (JPY) against G-10 and Asian currencies. The adjustment has increased flexibility by placing a 1.0% upper end on the 10-year Japan Government Bonds (JGB) yield range as a reference

[ad_1] The currency pair maintained its position above the 149.00 marker during the early Asian trading hours on Tuesday, registering a daily change of 0.04%. This stability comes in light of speculation around the Bank of Japan’s (BoJ) potential alterations to its Yield Curve Control (YCC) approach, as suggested by a report, which has lent

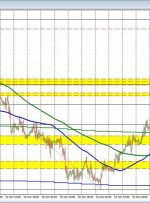

[ad_1] Japanese Yen Prices, – USD/JPY Charts and Analysis USD/JPY remains stuck just below 150.00. US/Japan rate differential contracts. US data will steer USD/JPY ahead of next week’s BoJ meeting. Recommended by Nick Cawley Get Your Free JPY Forecast The Bank of Japan gathers for a two-day meeting at the end of the month with

[ad_1] Euro, EUR/USD, US Dollar, Treasury Yields, Trend Break – Talking Points Euro appears to be re-asserting itself against the US Dollar Treasury yields have pulled back from recent peaks with a changing mood If the macro picture remains supportive, will technicals boost EUR/USD? Recommended by Daniel McCarthy Get Your Free EUR Forecast The Euro

[ad_1] Share: Indian Rupee trades firmly, supported by the potential aggressive intervention by the Reserve Bank of India (RBI). A rise in US Treasury yields and higher crude oil prices might cap the upside of the Indian Rupee. Investors will focus on the RBI Forex swap maturity, US economic data. Indian Rupee (INR)

[ad_1] The day started with US yields down marginally after overnight saw the 30-year bond yield touch 5.0% (at 5.01%) before buyers came in and pushed the yield lower. The yield reached the highest level since August 2007 before retreating.. The 10-year yield reached 4.884% and likewise backed off those elevated levels. For the 10

[ad_1] © Reuters. Investing.com– Most Asian currencies moved little on Friday, but stemmed some recent losses as the dollar came off 10-month highs and Treasury yields stalled before key U.S. inflation data due later in the day. Regional currencies were battered by a spike in the dollar and Treasury yields this week, after hawkish signals