[ad_1] Article by IG Senior Market Analyst Axel Rudolph FTSE 100, DAX 40, Nasdaq 100 Analysis and Charts FTSE 100 nears last week’s high Despite disappointing UK retail sales, which last week slid to their lowest level since the 2021 COVID-19 lockdown, the FTSE 100 remains on track to reach last week’s high at 7,535

[ad_1] Share: Economists at Rabobank analyze GBP outlook against USD and EUR. Potential for further downside risks to Cable In view of downside risks to global growth, we expect the USD to remain well supported in the coming months as subdued levels of risk appetite underpin safe-haven assets. This suggests potential for further

[ad_1] Article by IG Senior Market Analyst Axel Rudolph FTSE 100, S&P 500, Russell 2000 Analysis and Charts FTSE 100 recovery runs out of stream The FTSE 100 has come off Thursday’s 7,466 high amid hawkish comments by the US Federal Reserve (Fed) Chair Jerome Powell and as the British economy stalls in the third

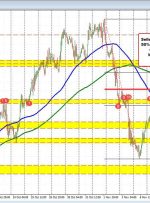

[ad_1] The USDCAD raced lower last week and continued that fall yesterday to a low of 1.36284. However, the move lower stalled, and the price moved back above a swing area between 1.3659 and 1.3668 (and held support on a dip). Sellers turn the buyers and that momentum has continued in trading here today. The

[ad_1] Article by IG Senior Market Analyst Axel Rudolph FTSE 100, DAX 40, S&P 500 Analysis and Charts FTSE 100 hovers above support The FTSE 100 ended last week on a high and managed to rally to 7,484, close to the 55-day simple moving average (SMA) at 7,497, following softer US employment data, rapidly falling

[ad_1] Investing.com – The U.S. dollar edged lower in early European trade Monday, falling to a six-week low and extending last week’s declines on the back of a less hawkish stance from the Federal Reserve. At 03:20 ET (08:20 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, edged

[ad_1] Share: GBP/USD regains 1.22. Economists at Scotiabank analyze the pair’s outlook. Sterling’s short-term pattern of trade looks encouraging Sterling’s short-term pattern of trade looks encouraging and the resilience of demand for the Pound on weakness over the past month or more is notable. Trend momentum is supportive on the intraday studies but

[ad_1] As 10-year Treasury yields basically undoes whatever happened in October, equities are finding much comfort especially in the last two days. Tech stocks have been surging but general sentiment in itself is extremely buoyed as major indices look to wrap up the week with another round of gains. That would make it five for