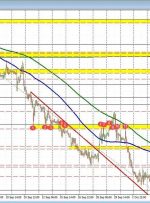

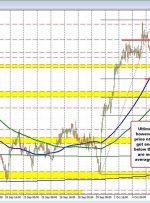

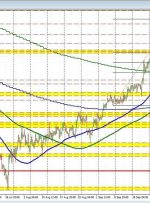

[ad_1] Today I present you an overview of trades made using the Owl strategy – smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from October 2 to 6, 2023. There were a total of 5 trades opened in all currency pairs. The Owl Smart Levels indicator traded currency pairs both for buying and