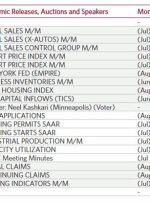

[ad_1] Mon: PBoC LPR, German PPI (Jul) Tue: US Richmond Fed Index (Aug), New Zealand Retail Sales (Q2) Wed: EZ/UK/US Flash PMIs (Aug), Canadian Retail Sales (Jun), US New Home Sales (Jul) Thu: Fed’s Jackson Hole Symposium (24-26th Aug), CBRT Announcement, BoI Announcement, BoK Announcement,US Durable Goods (Jul) Fri: Fed’s Jackson Hole Symposium (24-26th Aug),