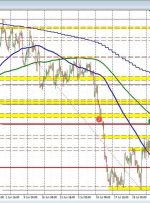

[ad_1] Euro, EUR/USD, RSI Divergence – Technical Update: Euro at 6-week loss, 7th would mean longest since 2014 EUR/USD confirms breakout under key rising support Watch for positive RSI divergence on the 4-hour chart Recommended by Daniel Dubrovsky Get Your Free EUR Forecast At 6 weeks, the Euro is on its longest consecutive losing streak