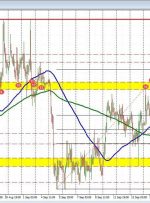

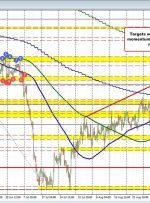

[ad_1] Today I present you an overview of trades made using the Owl strategy – smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from September 11 to 15, 2023. The market was quite clearly undecided on the direction of its movement, and only 2 trades were opened in total. For convenience and timely