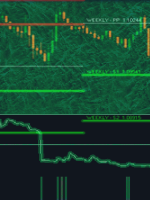

[ad_1] Article written by Axel Rudolph, Senior Market Analyst at IG USD/JPY puts pressure on its 10-month high There is no stopping USD/JPY’s advance as the US dollar is on track for its tenth consecutive week of gains amid the Federal Reserve’s (Fed) hawkish pause while the Bank of Japan (BOJ) rigorously holds onto its