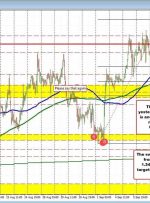

[ad_1] Number of traders net-short has decreased by 29.16% from last week. SYMBOL TRADING BIAS NET-LONG% NET-SHORT% CHANGE IN LONGS CHANGE IN SHORTS CHANGE IN OI USD/CAD BEARISH 52.75% 47.25% -0.65% Daily 20.68% Weekly -16.90% Daily -29.16% Weekly -9.05% Daily -9.43% Weekly of clients are net long. of clients are net short. Change in Longs