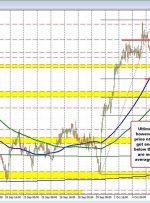

[ad_1] Share: Canadian Dollar flows are resurfacing after Thursday’s nosedive, propped up by a reinvigorated oil bid. Canada economic data remains thin until Tuesday’s CPI print. US Dollar giving back yesterday’s gains after consumer sentiment miss. The Canadian Dollar (CAD) caught a mild recovery on Friday, paring back Thursday’s dip after broad-market risk