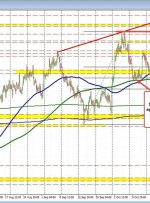

[ad_1] Share: The Canadian Dollar is bounding higher, extending weekly gains. Canada Unemployment Rate missed forecasts, hampering CAD upside. CAD gains 17.5K jobs, entirely part-time employment; wage growth also lower. The Canadian Dollar (CAD) is seeing further upside against the US Dollar (USD) after a US Nonfarm Payrolls (NFP) report that came in