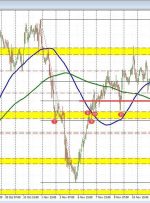

[ad_1] Share: USD/CAD seems biased to move downward despite the weakening in Crude oil prices. WTI prices lose ground on an unexpected delay in an upcoming OPEC+ meeting. US economic data turn investors to perceive persistent inflation in the country. USD/CAD seems to extend its losses for the third consecutive session, trading slightly