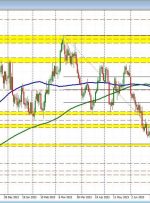

[ad_1] Share: Fed officials unanimously aim for the 2% inflation target, but divisions arise on the next steps. The US Dollar Index (DXY) reflects the greenback’s strength, rising 0.29% to 103.497, supported by rising US Treasury bond yields. USD/CAD’s bullish momentum is evident as it trades above the 200-day Moving Average, with key