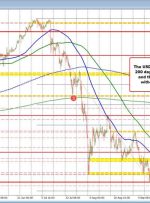

[ad_1] USD/JPY ANALYSIS Key Japanese officials reiterated cautious approach. Japan’s inflation report will be the focal point for the pair next week. 50-day MA break could spark USD/JPY decline. Elevate your trading skills and gain a competitive edge. Get your hands on the JAPANESE YEN Q4 outlook today for exclusive insights into key market catalysts

[ad_1] There will definitely be a lot to say, now especially as the Japanese yen has fallen in the aftermath of their policy decision today. But I reckon Ueda will continue to maintain that they do acknowledge firmer inflation developments but they’re not at a point yet to abandon easy policy altogether. Essentially, it should

[ad_1] With USD/JPY knocking on the door of 150 stay tuned for a speech from Bank of Japan Governor Ueda. 0635 GMT, which is 0235 US Eastern time He’ll be speaking an annual trust association meeting Trying to hold back the wave. The BOJ has once again shown commitment to easy policy today: [ad_2] لینک

[ad_1] High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do

[ad_1] More again from Bank of Japan Governor Ueda, trying his hand at some verbal intervention to support the yen. Who wants to tell the Gov that a 500-odd bp yield differential between the US and Japan is a very strong fundamental that is moving the USD/JPY rate? Ueda: important for FX to move stably