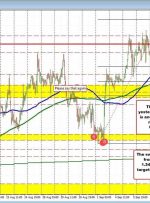

[ad_1] Share: USD/CAD strengthens due to the Fed’s hawkish tone on interest rates trajectory. Stronger US jobs data bolster the US yields; contributing support for the US Dollar. Downbeat Crude oil prices put pressure on the Canadian Dollar. USD/CAD traces the upward path on the fourth successive day, trading higher near 1.3710 during