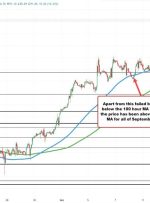

Japanese Yen Prices, Charts, and Analysis FOMC decision on Wednesday, the Bank of Japan on Friday. USD/JPY struggles with resistance. Learn How to Trade USD/JPY Recommended by Nick Cawley How to Trade USD/JPY The Federal Reserve (Fed) and the Bank of Japan (BoJ) will both announce their latest monetary policy decision this week – Wednesday