[ad_1] Market Recap Recommended by Jun Rong Yeap Get Your Free Equities Forecast It was another down day in Wall Street, as statements from the Federal Open Market Committee (FOMC) minutes did not reflect the level of unity among policymakers to pause rates as what was initially expected. Particularly, the key takeaway that “most participants

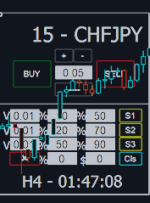

[ad_1] If you have any questions, please do not hesitate to contact us. You can reach me from my profile. My profile: https://www.mql5.com/en/users/farjamim/seller My product: ⭐️⭐️⭐️⭐️⭐️Trade Panel MT5- https://www.mql5.com/en/market/product/103838 ⭐️⭐️⭐️⭐️⭐️ Trade Panel MT4- https://www.mql5.com/en/market/product/103435 ⭐️⭐️⭐️⭐️⭐️ABCDE MT5 – https://www.mql5.com/en/market/product/99159 ⭐️⭐️⭐️⭐️⭐️ ABCDE MT4 – https://www.mql5.com/ru/market/product/99208 ⭐️⭐️⭐️⭐️⭐️ MT4 Special Candle – https://www.mql5.com/ru/market/product/99257 ⭐️⭐️⭐️⭐️⭐️ MT5 Reverse Candle – https://www.mql5.com/en/market/product/102507

[ad_1] EUR/USD daily MUFG Research adds a new short EUR/USD position to its trade of the week portfolio targeting a move towards 1.0770, with a stop at 1.1160. “We have instigated a short EUR/USD trade idea to reflect the potential bias favouring yield and hence the dollar over the short-term,” MUFG notes. “So far in

[ad_1] AUD/USD ANALYSIS & TALKING POINTS Concerns around Chinese economy increase leaving AUD under pressure. Fed speakers under the spotlight later today. Bears eye 0.6500. Recommended by Warren Venketas Get Your Free AUD Forecast AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP The Australian dollar has slid further this Tuesday morning as Chinese import and export numbers (refer to

[ad_1] © Reuters. Investing.com — Most Asian currencies fell on Tuesday as disappointing Chinese trade figures weighed on sentiment, while the dollar advanced amid uncertainty over the Federal Reserve and anticipation of key inflation readings this week. Government data showed that both Chinese and shrank at their fastest pace since the 2020 COVID-19 pandemic, pointing