[ad_1] Toolbar Collapse toolbar. Settings. Chart screenshot. Settings and screenshot storage location here. Order control panel. Risk manager and Trading report. Info panel. Chart control panel. Trading. OCO orders. General order closure. Tasks. Trailing stop. Breakeven. Partial closure. Alerts. Server time. Using settings you can change the displayed information to: Server time | Time until

[ad_1] Feeling lost in the world of forex trading? You’re not alone. Many beginners find it hard to understand this complex market. The market is huge, with $7.5 trillion traded every day. But don’t worry. This guide will make the basics easy to learn. We’ll cover everything from currency pairs to winning strategies. You’ll learn

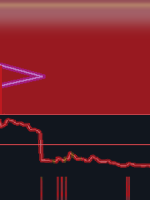

[ad_1] Hello Traders, we had a trade on EURNZD on H1 time-frame that today 29 November 23 the market already moved +1500 Points! In this trade we had first a red triangle of the Italo Triangle Indicator showing that the market is going to trend. The confirmation was the neon red line of Italo Volume Indicator above

[ad_1] © Reuters. FILE PHOTO: Corn plants are seen at sunset in a farm near Rafaela, Argentina, April 9, 2018. REUTERS/Marcos Brindicci/File Photo By Maximilian Heath BUENOS AIRES (Reuters) – Argentina’s grains trade is largely “paralyzed” by a lack of soybeans due to drought and farmers holding onto produce, anticipating a devaluation of the peso

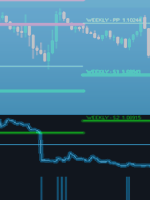

[ad_1] Hello Traders, we had a trade on EURCAD on H1 time-frame that today 21 November 23 the market already moved +5100 Points! In this trade we looked first at green candles from Italo Trend showing that the market is going to trend. The last confirmation of the trend trade were the neon green line of Italo