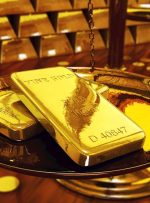

[ad_1] XAU/USD, XAG/USD PRICE FORECAST: MOST READ: GBP Price Action Setups: GBP/USD, EUR/GBP, GBP/AUD Post UK CPI Gold extended its gains throughout the day today in light of increased risk aversion from market participants. The rise of the risk-off environment today comes courtesy of an explosion of a hospital in Gaza last night which saw