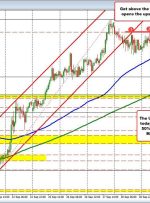

[ad_1] To kickstart your trading day in the Forex on September 27, 2023, I take a look at the EURUSD, USDJPY, and GBPUSD from a technical perspective: EURUSD: The EURUSD yesterday and today tested the low swing area (between 1.04846 and 1.05335) and found willing buyers each time. The price did move above the high

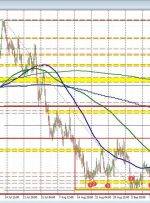

[ad_1] The AUDUSD technical story remains largely the same. The pay remains within its up-and-down trading range (see red box on the chart below) with a short-term negative bias. The negative technical bias comes because the price is below the 100 and 200 bar moving averages on the 4-hour chart between 0.6423 and 0.6436. Staying

[ad_1] US: The Fed left interest rates unchanged as expected. The macroeconomic projections were revised higher as the economy showed much stronger resilience than expected and the Dot Plot showed that the majority of members still expects another rate hike by the end of the year with less rate cuts in 2024. Fed Chair Powell

[ad_1] Trade Smarter – Sign up for the DailyFX Newsletter Receive timely and compelling market commentary from the DailyFX team Subscribe to Newsletter AUD/USD TECHNICAL ANALYSIS AUD/USD retreated on Wednesday, dragged down by the Fed’s hawkish monetary policy outlook, but continued to carve out a double bottom, a reversal technical formation typically symptomatic of a

[ad_1] US: The Fed hiked by 25 bps as expected and kept everything unchanged at the last meeting. Fed Chair Powell reaffirmed their data dependency and kept all the options on the table. The US CPI last week came in line with expectations, so the market’s pricing remained roughly the same. The labour market displayed

[ad_1] US: The Fed hiked by 25 bps as expected and kept everything unchanged at the last meeting. Fed Chair Powell reaffirmed their data dependency and kept all the options on the table. The US CPI this week came in line with expectations, so the market’s pricing remained roughly the same. The labour market displayed

[ad_1] Euro, EUR/USD, US Dollar, EUR/JPY, Japanese Yen, EUR/GBP, British Pound, Trend, Range – Talking Points Euro bearishness might be intact against the US Dollar in the near term The bullish case for EUR/JPY could have some legs after a brief plunge EUR/GBP may see a breakout at some stage. What are the levels to