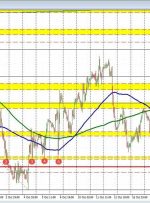

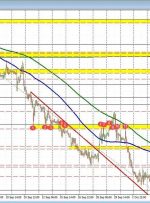

[ad_1] Euro, EUR/USD, US Dollar, Treasury Yields, Trend Break – Talking Points Euro appears to be re-asserting itself against the US Dollar Treasury yields have pulled back from recent peaks with a changing mood If the macro picture remains supportive, will technicals boost EUR/USD? Recommended by Daniel McCarthy Get Your Free EUR Forecast The Euro