[ad_1] استراتژی اسکالپینگ آتی یک تکنیک معاملاتی سریع است که بر حرکت های کوچک قیمت در بازار آتی تمرکز دارد. برای دستیابی به سودهای ثابت نیاز به ذهنیت، تمرکز و رویکرد ساختاری خاصی دارد. درک اصول معاملات آتی، از جمله قراردادهای خرید/فروش دارایی ها مانند کالاها و ارزها، ضروری است. تجارت موفق به دانش، تجزیه

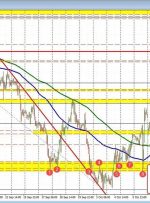

[ad_1] The EURGBP – a major cross-currency pair – has seen up-and-down price action today. The initial low found support near the low of a swing area and 0.86982. The subsequent move back to the upside took the price up to 0.8725 before rotating back down again to retest the low from earlier today. Now,

[ad_1] Swing Point Highs and Lows are vital concepts in technical analysis, forming the cornerstone for traders and investors to make informed decisions. In the world of forex trading, these indicators hold immense significance, allowing individuals to identify potential trend reversals, entry and exit points, and overall market sentiment. In this article, we’ll delve into

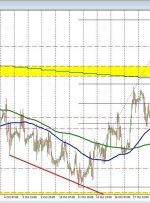

[ad_1] This week, the USDCHF has experienced an upward price movement, consistently remaining above the key swing area range of 0.89347 to 0.89472. The price surpassed this range in yesterday’s trading session and has maintained its position above this threshold today. Looking upwards, there’s a notable trend line at 0.8984, followed by a significant range

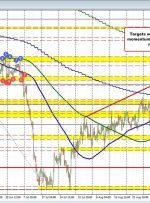

[ad_1] Gold, Silver, Trendlines, Symmetrical Triangle – Technical Update: Gold prices remain focused lower as resistance holds Silver faces key rising support since September 2022 What are key technical levels to watch going forward? Recommended by Daniel Dubrovsky Get Your Free Gold Forecast XAU/USD Analysis Gold prices have been aiming cautiously lower in recent days,

[ad_1] “If economic activity continues at a strong pace, it could lead to a return to inflation,” Dallas Federal Reserve Bank Governor Laurie Logan said Friday, adding that “the strength of the labor market indicates that we (at the Fed) haven’t finished the work on restoring price stability yet.” These important statements by a representative