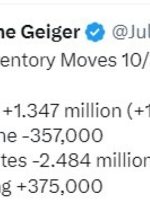

[ad_1] This is from the privately surveyed oil stock data ahead of official government data tomorrow morning out of the US. Via Twitter: I had seen a different number elsewhere for the distillates. — Expectations I had seen centred on: Headline crude -0.3mn barrels Distillates -1.5 mn bbls Gasoline -0.8 mn — This data point

[ad_1] This is from the privately surveyed oil stock data ahead of official government data tomorrow morning out of the US. Numbers via Twitter … not the expectations I had below the screenshot are closer to the result: — Earlier: Goldman Sachs sees Brent crude oil prices to USD100/bbl by June as stocks ‘descend gently’

[ad_1] Melbourne Institute monthly inflation gauge flat m/m prior +0.2% +5.7% y/y prior +6.1% For the trimmed mean, +0.1% m/m and +5.1% y/y prior +0.1% m/m and +5.7% y/y This indicator is moving in the right direction for the RBA. CPOI levels are still elevated though. And the trimmed mean, while having dipped, is showing

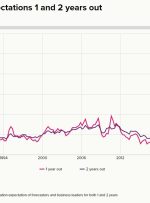

[ad_1] Highest for this since late April. ANZ comments on the still dour result, looking for the bright side: While it remains at very low levels, there are signs of tempered optimism amongst households. Inflation expectations also fell to 4.9% – the lowest since Feb 2022 This article was written by Eamonn Sheridan at www.forexlive.com.

[ad_1] > UK RICS housing survey for July -53 versus -50 estimate UK RICS housing survey for July 2023 Prior month -46 revised 2-48 RICs housing survey for July -53 versus -50 estimate. This is the lowest since April 2009 agreed sales balance -44 versus -36 last month. Lowest since April 2020 near-term rental price

[ad_1] © Reuters. FILE PHOTO: A worker at the Lithuanian mint holds a silver coin, produced to be exchanged for sets of digital currency released by Lithuanian central bank in Vilnius, Lithuania June 1, 2020. REUTERS/Andrius Sytas/File Photo By Marc Jones LONDON (Reuters) – The most comprehensive survey of the global investment industry on central