[ad_1] This is the manual for the Zone Trade EA available here: https://www.mql5.com/en/market/product/127753 The EA is a manual trading tool for trades to automatically take trades at support and resistance or supply and demand zones using price action entries within those areas. It is designed to be used as a position trading tool meaning there are

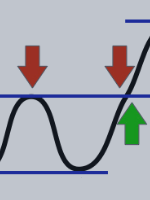

[ad_1] Support occurs when falling prices stop, change direction, and begin to rise. Support is often viewed as a “floor” which is supporting, or holding up, prices. Resistance is a price level where rising prices stop, change direction, and begin to fall. Resistance is often viewed as a “ceiling” keeping prices from rising higher. If

[ad_1] USD/CAD PRICE, CHARTS AND ANALYSIS: Read More: The Bank of Canada: A Trader’s Guide USDCAD Continues its slide today helped by a weaker US Dollar and a rebound in Oil prices. Having broken the ascending trendline on Friday the selloff has gathered a bit more momentum but faces some technical hurdles ahead. Despite more

[ad_1] New Features Version 2.43: 1. Support and Resistance levels can now be conveniently placed by clicking the “Z” button. 2. Automatic execution of buy or sell orders upon the symbol price reaching the Support or Resistance Zone. 3. Receive notifications on your MetaQuotes ID whenever an order is automatically initiated within the SR Zones.

[ad_1] USD The Fed left interest rates unchanged as expected at the last meeting with basically no change to the statement. Fed Chair Powell stressed once again that they are proceeding carefully as the full effects of policy tightening have yet to be felt. The recent US CPI missed expectations across the board bringing the

[ad_1] USD/CAD ANLAYSIS & TALKING POINTS Moderating Canadian inflation unable to shake CAD bulls just yet. US durable goods orders, consumer sentiment and BoC’s Macklem in focus later today. Will channel support hold firm once again? Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast

[ad_1] Share: Economists at ING are bullish on the NZD/USD and are interested in whether the new government changes the Reserve Bank of New Zealand’s remit – a potentially bullish factor for the Kiwi. New government, higher rates? The New Zealand Dollar should benefit like AUD from a gradual optimistic rerating of growth

[ad_1] Are you tired of feeling like you’re stumbling in the dark when it comes to forex trading? The struggle to find a reliable indicator is real. If you’ve been through the cycle of using confusing tools that lead to more losses than gains, you’re not alone. It’s a common challenge faced by many traders.Imagine

[ad_1] RAND TALKING POINTS & ANALYSIS Rand unable to capitalize on US initial jobless claims data. Fed officials to relate recent US economic data. Bullish divergence at trendline support could see some SUD upside to come. USD/ZAR FUNDAMENTAL BACKDROP Macro-economic fundamentals underpin almost all markets in the global economy via growth, inflation and employment –