[ad_1] Mon: Market Holiday: Japan (Autumnal Equinox); EZ, UK & US Flash PMIs (Sep), US National Activity Index (Aug) Tue: RBA Policy Announcement; German Ifo (Sep), US Consumer Confidence (Sep), Richmond Fed (Sep) Wed: Riksbank & CNB Policy Announcements; Australian CPI (Aug), US Building Permits Revision (Aug), New Home Sales (Aug), UK CBI Trends (Sep)

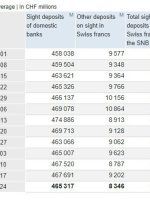

[ad_1] Domestic sight deposits CHF 465.3 bn vs CHF 467.7 bn prior Swiss sight deposits fall in the past week but still sits in the recent range of overall levels seen since the end of October. Here’s a snapshot: This article was written by Justin Low at www.forexlive.com. [ad_2] لینک منبع : هوشمند نیوز

[ad_1] Share: USD/CHF could register losses on the less likelihood of Fed interest rate hikes. Swiss Franc could lose ground as SNB reduced foreign currency reserves to a seven-year low. Improved US Treasury yields attempt to push the US Dollar into positive territory. USD/CHF moves sideways after two days of minor gains, bidding

[ad_1] Share: The Swiss Franc (CHF) has proven to be the strongest G10 currency in the world this year. Economists at ING analyze EUR/CHF outlook. 2025 is when EUR/CHF will turn higher We think the SNB may tolerate EUR/CHF down near 0.95 during 2024 while it is still concerned with 2%+ inflation. Into

[ad_1] Share: Economists at Commerzbank expect the EUR/CHF pair to enjoy modest gains next year. Scope for a stronger Franc again in 2025 We see a moderate depreciation of the Franc against the Euro next year. The EUR should benefit from the fact that market expectations regarding interest rate cuts in the Eurozone