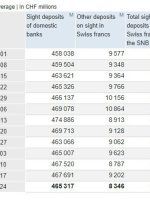

[ad_1] Domestic sight deposits CHF 465.3 bn vs CHF 467.7 bn prior Swiss sight deposits fall in the past week but still sits in the recent range of overall levels seen since the end of October. Here’s a snapshot: This article was written by Justin Low at www.forexlive.com. [ad_2] لینک منبع : هوشمند نیوز