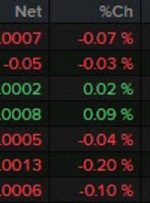

[ad_1] The strongest to the weakest of the major currencies As the North American session begins, the NZD is the strongest of the major currencies while the USD is the weakest. In Europe, data was largely weaker than expectations which has sent yields lower and led to gains in stocks in Europe and the US.

[ad_1] The major US stock indices are trading at session lows as European traders start to look for the exits for the week. The NASDAQ index is now down around 1.3%. The S&P index is down -0.89%. All the major indices are back below its 50 day moving averages after closing above those moving averages

[ad_1] In the world of forex trading, timing is everything. Knowing the optimal times to trade can significantly impact your trading success. One invaluable tool that can assist traders in this endeavor is the Forex Market Hours GMT Trading Session MT4 Indicator. In this article, we’ll delve into the importance of market hours, the functionality

[ad_1] And that is weighing on the dollar slightly, but nothing too significant. Of note, it is the euro and pound which are advancing just a touch more against the dollar after having previously stuck in narrow ranges in Asia. EUR/USD was holding in a 13 pips range earlier but is now extending that to

[ad_1] S&P 500 futures I’m looking out for any headlines to have caused the turn here but I can’t really pinpoint any specific ones. The turn is coming as general equities sentiment is switching around, with tech stocks now leading the way. Nasdaq futures in particular is up 0.6% after having been down 0.3% earlier.

[ad_1] A few more economic releases expected in the new trading day in Asian. At 7:01pm ET, the UK’s BRC Retail Sales Monitor is forecast to come in at a year-on-year (y/y) increase of 3.0%, down from the previous 4.2%. At 7:30pm ET, Japan’s Average Cash Earnings for June are projected to report a 3.0%

![[+4,6730] Live Trading Session Using “Supply Demand EA Pro” (2/6/2023) – Analytics & Forecasts – 6 October 2023 [+4,6730] Live Trading Session Using “Supply Demand EA Pro” (2/6/2023) – Analytics & Forecasts – 6 October 2023](https://shmi.ir/wp-content/uploads/2023/10/46730-Live-Trading-Session-Using-Supply-Demand-EA-Pro-262023-150x203.jpg)