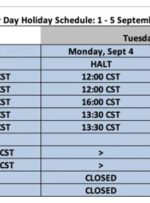

[ad_1] First of all a reminder: US and Canadian cash markets will be closed today because of the Labour Day celebration, obviously resulting in diminished flows this afternoon. Going back in chronological order, APAC is led by the excellent performance of the China50 and especially Hong Kong where a surge on real estate stocks helped