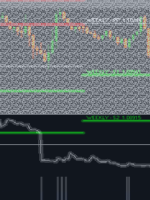

[ad_1] Hello Traders, we had a trade on AUDJPY on H1 time-frame that today 15 September 23 the market already moved +3000 Points! In this trade we looked first at the Italo Pivots green support line, the market touches and rejects it, in this rejection I got grey candles from Italo Trend, grey candles from