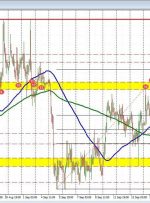

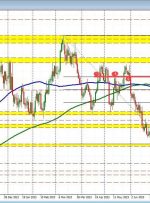

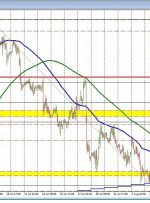

[ad_1] As the week comes to an end, the USDJPY fell sharply and in the process tested the low from early November at 149.175. The low reached 149.192 before bouncing. The price is trading at 149.74. The double bottom mirrors the double top from the high this week (on Monday). That high was reached on