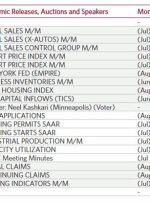

[ad_1] Coming up at 8.30 am US Eastern time today, July retail sales data from the US: Preview comments from Bank of America, looking for a solid beat. Bolding is mine: We expect a robust retail sales report for July Over the last two trading days, BofA Global Research analysts have published 12 notes on