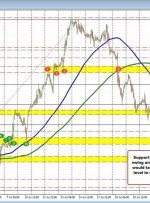

[ad_1] Share: EUR/JPY consolidates within the 157.00/158.50 range, with an upward bias influenced by ECB President Christine Lagarde’s hawkish tone on inflation. Technical indicators suggest a new trading range could form if the pair falls below 157.00, with key levels at August 3 low of 155.53 and August 23 low of 156.87. A