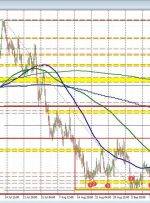

[ad_1] Gold, Retail Trader Positioning, Technical Analysis – IGCS Update Gold prices aiming for best week since mid-July Yet, outlook remains bearish based on retail bets What are key technical levels to watch ahead? Recommended by Daniel Dubrovsky Get Your Free Gold Forecast At +1.5%, gold prices are so far on course for the best