[ad_1] Mon: N/A Tue: RBA Announcement & SoMP, UK Jobs (Dec), Swedish CPIF (Jan), German ZEW (Feb), Canadian CPI (Jan), Japanese Trade Balance (Jan) Wed: FOMC Minutes, RBNZ Announcement, Bank of Indonesia Announcement, Chinese House Prices (Jan), UK CPI (Jan) Thu: PBoC LPR, Australian Jobs (Jan), EZ Consumer Confidence (Feb), Japanese CPI (Jan) Fri: UK

[ad_1] Mon: N/A Tue: RBA Announcement & SoMP, UK Jobs (Dec), Swedish CPIF (Jan), German ZEW (Feb), Canadian CPI (Jan), Japanese Trade Balance (Jan) Wed: FOMC Minutes, RBNZ Announcement, Bank of Indonesia Announcement, Chinese House Prices (Jan), UK CPI (Jan) Thu: PBoC LPR, Australian Jobs (Jan), EZ Consumer Confidence (Feb), Japanese CPI (Jan) Fri: UK

[ad_1] KIWI DOLLAR TALKING POINTS AND ANALYSIS Fed peak + RBNZ hawkishness supportive of NZD. All eyes shift to the US for the rest of the trading week. Technical signals point to downside to come. Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of

[ad_1] Investing.com– Most Asian currencies rose on Wednesday as less hawkish signals from Federal Reserve officials ramped up hopes for an early interest rate cut in 2024, which put the dollar near four-month lows. The was the best performer for the day, rallying nearly 1% after the Reserve Bank of New Zealand , but flagged

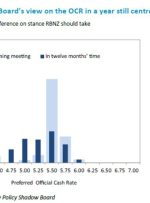

[ad_1] RBNZ Governor Orr press conference following the policy decision: RBNZ leaves cash rate unchanged at 5.5%, as expected RBNZ Policy Meeting: NZD/USD surges Via Westpac: The risk of an RBNZ rate hike “is real” From Orr: Meeting with new PM was highly constructive We’ve been adamant on holding rates through next year Projection shows

[ad_1] Share: NZD/USD loses momentum above the mid-0.6000s on Monday. Reserve Bank of New Zealand (RBNZ) is anticipated to hold the Offical Cash Rate (OCR) at 5.50% on Wednesday. US S&P Global Manufacturing PMI dropped to 49.4 vs. 50.0 prior, below the market consensus. RBNZ interest rate decision and US Gross Domestic Product

[ad_1] Share: Economists at ING are bullish on the NZD/USD and are interested in whether the new government changes the Reserve Bank of New Zealand’s remit – a potentially bullish factor for the Kiwi. New government, higher rates? The New Zealand Dollar should benefit like AUD from a gradual optimistic rerating of growth