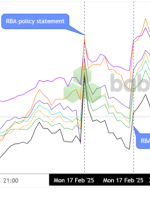

Bullock ، فرماندار RBA پس از داشتن نرخ بهره به طور غیر منتظره ای در مورد چشم انداز سیاست صحبت می کند

[ad_1] میشل بولاک ، فرماندار بانک مرکزی استرالیا (RBA) در حال سخنرانی در کنفرانس مطبوعاتی است و دلیل ترک غیر منتظره از نرخ سود کلیدی بدون تغییر در 3.85 ٪ در جلسه سیاست ماه ژوئیه را توضیح می دهد. بولاک به عنوان بخشی از قالب گزارش جدید برای بانک مرکزی که امسال آغاز شده است