[ad_1] Reserve Bank of Australia (RBA) Governor Michele Bullock is speaking at the press conference, explaining the reason behind trimming the key interest rate by 25 basis points (bps) to 3.6% in the August policy meeting. Bullock is taking questions from the press as part of a new reporting format introduced by the central bank

[ad_1] That (the discussion) is not happening We have not seen enough evidence of inflation moving to 2% yet to be confident Well, either way markets are still convinced that we’ll get to this point by some time during the middle of next year. For now, with inflation still needing to trend lower, we can’t

[ad_1] © Reuters. FILE PHOTO: A bank employee counts U.S. dollar notes at a Kasikornbank in Bangkok, Thailand, January 26, 2023. REUTERS/Athit Perawongmetha By Gertrude Chavez-Dreyfuss and Samuel Indyk NEW YORK/LONDON (Reuters) -The U.S. dollar slid against most major currencies on Monday, with a measure tracking the greenback’s value on track for its biggest monthly

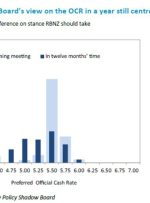

[ad_1] Share: NZD/USD loses momentum above the mid-0.6000s on Monday. Reserve Bank of New Zealand (RBNZ) is anticipated to hold the Offical Cash Rate (OCR) at 5.50% on Wednesday. US S&P Global Manufacturing PMI dropped to 49.4 vs. 50.0 prior, below the market consensus. RBNZ interest rate decision and US Gross Domestic Product

[ad_1] People’s Bank of China USD/CNY reference rate is due around 0115 GMT. The People’s Bank of China (PBOC), China’s central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate system that allows the value of the yuan to

[ad_1] The exchange rate witnessed a notable drop to 17.17 during European trading hours today, as market participants digest the culmination of the Federal Reserve’s interest rate hikes and anticipate further economic indicators from S&P Global PMI data. Earlier this week, on Tuesday, the Federal Open Market Committee (FOMC) released minutes that were perceived as