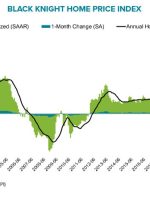

Earlier today, Teranet and National Bank released the latest edition of their house price index for Canada. It showed that prices boomed 1.8% from June to July in the fifth consecutive monthly increase. The rise is the second-largest in a single month, surpassed only by July 2006. Seasonally adjusted, prices were up 2.4% m/m with