[ad_1] The ranges from the survey are useful to be aware of for such high-profile data. When the actual results fall outside the range of estimates the market impact can be outsized. I posted earlier in the week the range of estimates for the ADP data, which then came in well below. The market response

[ad_1] Hewlett Packard Enterprise Co. is a global edge-to-cloud company, actively engaging in the provision of information technology, technology and enterprise products, solutions and services. It operates through various segments namely Compute (general purpose servers for multi-workload computing, workload optimized servers for demanding applications), High Performance Computing & Artificial Intelligence (offers hardware and software solutions

[ad_1] What time are NVDA earnings: Wednesday, 23rd August a 16:20 ET — 20 minutes after the bell, thought that time may not be exact. Nvidia (NVDA) is about to unveil its quarterly earnings, and the anticipation is insane. I can’t remember an earnings report that was this anticipated. The options market implies a 10.4%

[ad_1] Coming up at 8.30 am US Eastern time today, July retail sales data from the US: Preview comments from Bank of America, looking for a solid beat. Bolding is mine: We expect a robust retail sales report for July Over the last two trading days, BofA Global Research analysts have published 12 notes on

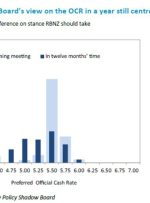

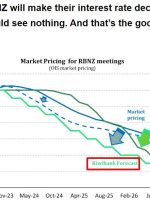

[ad_1] Coming up at 2pm New Zealand time on Wednesday, 16 August 2023 is the RBNZ policy decision. 0200 GMT and 10pm US Eastern time (on Tuesday, 15 August 2023) RBNZ Governor Orr’s press conference will follow an hour later Preview comments via ANZ: We expect the RBNZ will leave the OCR unchanged at 5.50%,

[ad_1] Via a Commerzbank note previewing the European Central Bank meeting decision due on Thursday. Analysts at the bank say that following the the ECB signalling a continuation of rate hikes for today’s meeting at its previous meeting, “the ECB is likely to find it difficult to move to a less explicit forward guidance without

[ad_1] TD is anticipating that the Fed will raise rates by 25 basis points, which will be the final increase. Even so, the analysts go on, the FOMC will likely continue to validate the dots while maintaining a hawkish tilt. It follows the tried-and-true “have your cake and eat it too” strategy. TD says they